Key Insights

|

|

|

For funds marketed under the Socially Responsible Investment (SRI) label in France, the clock is ticking. In January 2026, portfolio managers of SRI-labeled funds will need to ensure that at least 15% of the companies in high impact climate sectors (see Table 1) have set out a credible climate transition plan.1 This is one of the many requirements necessary for attributing the SRI label to a fund.2 The sector-specific approach ensures that the transition efforts are focused on the highest greenhouse gas (GHG) emitters in the portfolio.3

I previously wrote about possible strategies to engage companies on improving the credibility of their transition plans using research from Morningstar Sustainalytics’ Low Carbon Transition Ratings (LCTR). In this article, I’ll revisit my assessment to see what progress, if any, has been made in the credibility of companies’ climate transition plans. I’ll also lay out a practical approach for investors that must evaluate and disclose on the transition plans of portfolio companies.

Table 1. List of High Impact Climate Sectors (HICS) According to the SFDR

Agriculture, forestry, and fishing |

Mining and quarrying |

Manufacturing |

Electricity, gas, stream, and air conditioning supply |

Water supply, sewage, waste management, and remediation activities |

Construction |

Wholesale and retail trade, repair of motor vehicles and motorcycles |

Transportation and storage |

Real estate activities |

Source: Annex 1 to Regulation (EC) No 1893/2006 of the European Parliament and of the Council.

Considerable Progress on Transition Plans

My previous analysis in June 2024 showed that no company in the Sustainalytics research universe was assessed as aligned with the 1.5-degree scenario.4 I suggested engaging high climate impact sector (HCIS) companies that were only moderately or significantly misaligned, to support companies to become investible in the context of this label requirement. Over a year later, as of September 2025, not a single HCIS company was assessed by Sustainalytics as aligned with the Paris Agreement. However, there is evidence of some notable developments in climate transition plans.

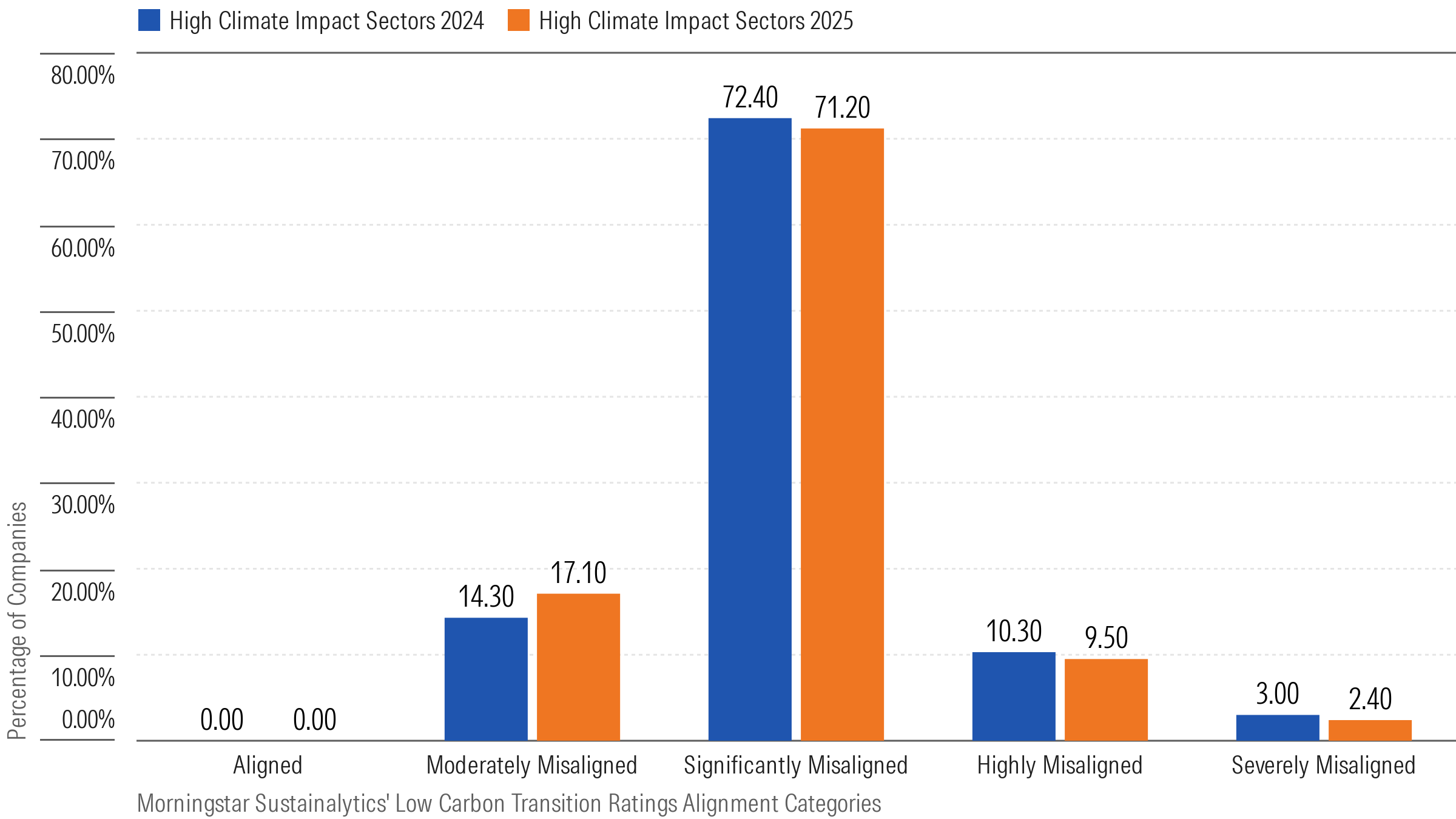

The current distribution of transition plan alignment shows fewer companies in the highly and severely misaligned categories (11.9% in 2025 vs. 13.3% in 2024) and more companies (17.1%) in the moderately misaligned category today compared to June 2024 (14.3%).

Figure 1. Comparison of High Climate Impact Companies Across LCTR Alignment Categories:

2024 vs. 2025

Source: Morningstar Sustainalytics. Data as of September 2025. For informational purposes only.

Even if the current commitments, targets, and management practices in place are not sufficient to be aligned with a 1.5-degree scenario, the shift in the distribution suggests an overall improvement in climate transition strategies among companies in the research universe.

Common Approaches for Assessing Transition Plan Credibility

With the French SRI label disclosure deadline on our doorstep, investors need a more nuanced approach to determine the credibility of company transition plans. As the Paris Agreement goal of limiting global warming to 1.5 degrees Celsius above pre-industrial levels seems to be realistically out of reach,5,6 it is not an adequate measure for monitoring and engaging companies on the details of their transition plans. Instead, investors need another standard to assess the credibility of the transition plans. While the French SRI label framework does not specify when a transition plan can be considered credible, the fifth appendix does include a list of the individual elements for assessing climate transition plans.7 Table 2 lists the French SRI label requirements for climate transition plan assessments alongside select corresponding Sustainalytics indicators.

Table 2. Elements to Assess the Climate Transition Strategies of ESG-Analyzed Issuers

Assessment of Climate Transition Strategies8 | Corresponding Morningstar Sustainalytics Indicators |

An analysis of the issuers’ various greenhouse gas emissions reduction targets (scopes 1, 2, and 3), including its 2050 objective and intermediate targets for the short, medium, and long term, as well as an analysis of the consistency between the trajectory defined by these targets and sectoral scenarios aligned with the climate objectives of the Paris Agreement. | Targets

|

Analysis of the resources committed by the issuer and their relevance to achieving the targets set (in particular the action plans in place, the financial resources allocated, and the company’s engagement strategy vis à vis its value chain to encourage emissions reductions). Particular attention will be paid to carbon offsetting mechanisms, which shall not be used as a tool to achieve set targets except in an ancillary way to address residual emissions. | Committed resources

Reduction programs

Strategy and supply chain engagement policy

|

Analysis of the issuers’ governance structure and the latter’s ability to implement the strategy for achieving climate ambitions, in particular the policies set out, the composition and involvement of its management bodies, the transparency of climate reporting and the extent to which “fair transition” (just transition) issues are taken into account. | Governance

Climate policies

Transparency

Just transition

|

Source: Morningstar Sustainalytics, Label ISR. For informational purposes only.

Note: This list of corresponding Sustainalytics indicators is non-exhaustive.

In the label requirements, three broad themes are apparent: analysis of issuers’ GHG reduction targets, analysis of resources committed to achieving those targets, and analysis of issuers’ governance structure. To support investors on the first requirement, focusing on GHG reduction targets between now and 2050, Sustainalytics provides several helpful indicators assessing the suitability of the targets and the associated programs overall, and per scope. The GHG reduction program indicators aim to address the consistency of the company’s proposed trajectory with the Paris Agreement, as required by the French SRI label.

The second requirement calls for an analysis of the resources committed to achieving GHG reduction targets, including the action plans issuers put in place. The investment alignment indicators can be used to evaluate monetary resources committed to the transition plan. These indicators make an assessment based on changes in capacity or production-related investment data. To assess investment alignment, company-specific assets are separated by technology and location to determine the degree to which the company’s investments will reduce or increase GHG emissions. For example, if an electric utility is making investments in renewable energy while decommissioning its coal-fired power plants, this could lead to an effective reduction of its emissions. The action plan is assessed via the GHG reduction program indicators.

The third requirement addresses issuers’ governance structure and value chain engagements. Governance may be evaluated using indicators that assess the experience of those in leadership roles and the issuer’s incentive plans. The indicators on workforce management and community management deal with the company’s actions to ensure that the implementation of the transition plan will not negatively impact the workforce or community.

Possible Practical Approaches to the SRI Label

The indicators outlined above could help fund managers by providing necessary insights to assess the transition plans of the highest emitters on their portfolios. Portfolio managers can, for instance, select only HCIS companies that score above 55 on the investment alignment indicators and above 75 on all other management indicators, which correspond with an assessment of strong management. This practical approach would concentrate the analysis on the elements mandated by the label requirements and identify more companies that have made progress on their climate transition plans.

What constitutes a credible transition plan remains open to interpretation, ranging from just committing to science-based targets to broader management system assessments. For investors that must determine and disclose on the transition plans of portfolio companies, evaluating the individual indicators linked to each of the assessment criteria is a practical way forward.

Meanwhile, since the French SRI label criteria were published in March 2024, the number of labeled funds decreased by almost 30% (from 1,354 funds in October 2023,9 to 980 by May 2025).10 This makes one wonder whether the stricter requirements have reduced the popularity of the label as a broad market standard. If this trend continues and fewer funds receive the SRI label, the designation might become a stronger signal, identifying more clearly those funds that rigorously assess climate transition plans, and setting them apart from the broader pool of standard SRI offerings.

References

- Label ISR. 2024. Référentiel du label. March 1, 2024. https://www.lelabelisr.fr/wp-content/uploads/EN_Referentiel-Label-ISR-mars24.pdf.

- Appendix 5 SRI label supported by public Authorities, Published March 2024. https://www.lelabelisr.fr/wp-content/uploads/EN_Referentiel-Label-ISR-mars24.pdf.

- Appendix 5 SRI label supported by public Authorities, Published March 2024. https://www.lelabelisr.fr/wp-content/uploads/EN_Referentiel-Label-ISR-mars24.pdf.

- Heijkants, E. “Living Up to the SRI Label: Strategies for Addressing Companies From High Impact Climate Sectors.” August 28, 2024. Morningstar Sustainalytics. https://www.sustainalytics.com/esg-research/resource/investors-esg-blog/living-up-to-the-sri-label--strategies-for-addressing-companies-from-high-impact-climate-sectors.

- Carrington, D. “World’s top climate scientists expect global heating to blast past 1.5C target.” May 8, 2024. The Guardian. https://www.theguardian.com/environment/article/2024/may/08/world-scientists-climate-failure-survey-global-temperature.

- Copernicus. "Copernicus: 2024 is the first year to exceed 1.5°C above pre-industrial level." January 10, 2025. https://climate.copernicus.eu/copernicus-2024-first-year-exceed-15degc-above-pre-industrial-level.

- Referentiel Label ISR. 2024. Annexe 5 (p.44) https://www.lelabelisr.fr/comment-investir/fonds-labellises/.

- Ibid

- Groupe Caisse des Dépôts. "Finance durable: Novethic publie son panorama des labels européens." Caisse des Dépôts. July 2023. https://www.caissedesdepots.fr/actualites/finance-durable-novethic-publie-son-panorama-des-labels-europeens.

- Fonds Labellisés. Le Label ISR. May 2025. https://www.lelabelisr.fr/comment-investir/fonds-labellises/.