Optimize your ESG investing processes with access to timely and comprehensive research supported by robust screening, reporting and portfolio monitoring tools through a single, web-based platform.

Sustainalytics’ Global Access is our client platform for accessing most of our core research and data products, including our flagship ESG Risk Ratings and Research. This user-friendly interface includes functionalities that enable clients to retrieve detailed company reports with qualitative analyses, screen companies on ESG criteria for security selection and product creation and run custom reports to communicate ESG performance. Clients subscribing to our Engagement Services can find all company-specific engagement reports and information. With the alerts functionality, clients can monitor their portfolios for ESG incidents and controversies.

Latest Insights

Eyes on Asia: How the Region Is Advancing on Human Rights Due Diligence

Controversial Weapons: Reassessing the Red Lines

The French SRI Label: A Practical Approach to Climate Transition Plan Assessments

Functionality available on Global Access

Research

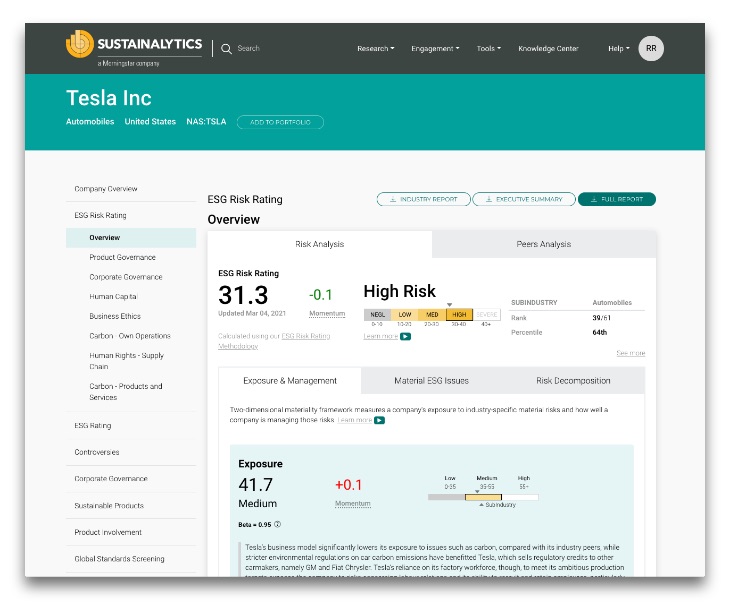

Access Timely, Comprehensive Research

Easily view overall, and indicator-specific, quantitative ESG and corporate governance data and read our qualitative analysts’ views

Identify controversial companies, see geographic distribution of incidents and read qualitative analyses with analysts’ outlook

Understand the nature and level of each company’s involvement in a range of controversial products and business activities

Identify companies deriving revenue from sustainable products and services

Screening and Reporting

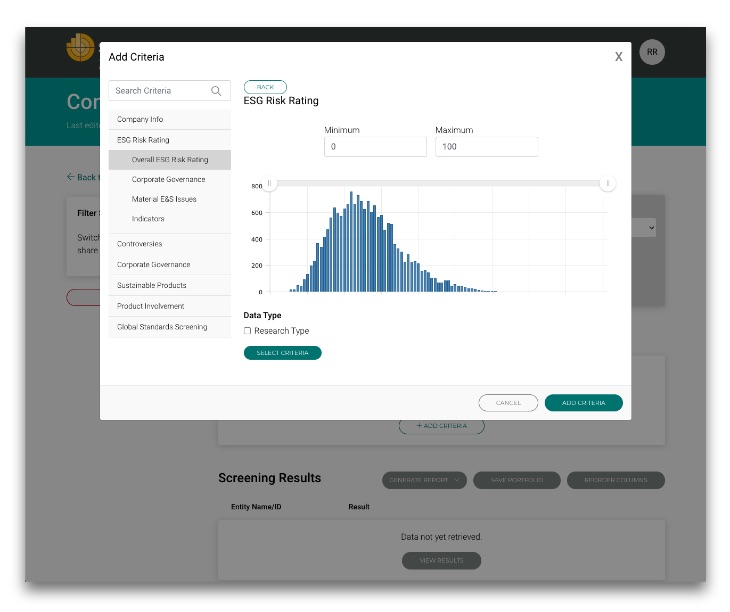

Robust Screening & Reporting Tools

Quickly and easily create custom screens and reports based on client mandates and/or your firm’s investment guidelines

Filter companies based on a broad range of ESG criteria with a robust screening tool

View filtered results on-screen, create investable universes based on screening criteria, and export results to Excel

Create custom Excel and .csv reports using our full range of research and analysis with an easy-to-use report generation tool

Portfolio Management

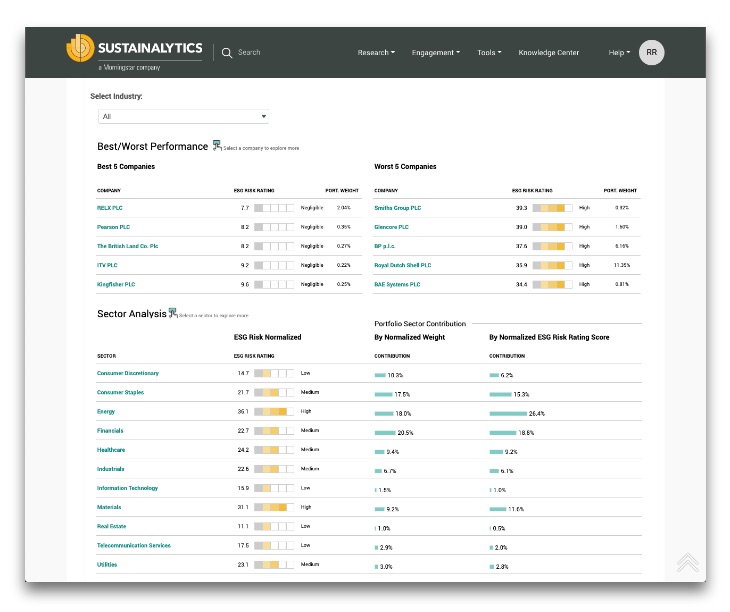

Track holdings with the Portfolio Management and Monitoring Tools

Easily integrate and manage your customized portfolios

Monitor the ESG performance of your holdings

Import, amend, and share portfolios through Global Access’ portfolio management feature

Receive semi-monthly email alerts on ESG-related incidents and events that may pose portfolio risk

Measure your portfolio’s ESG performance against a benchmark of your choice using our portfolio reports option

Corporate Engagement

Real-time Updates on Corporate Engagements

Quickly access real-time Engagement information with full transparency, including meeting minutes and transcripts

Proactively address specific ESG issues within portfolio companies, ranging from climate and child labor to plastics and cybersecurity

Promote and protect long-term shareholder value by engaging with high-risk companies on their financially material ESG issues

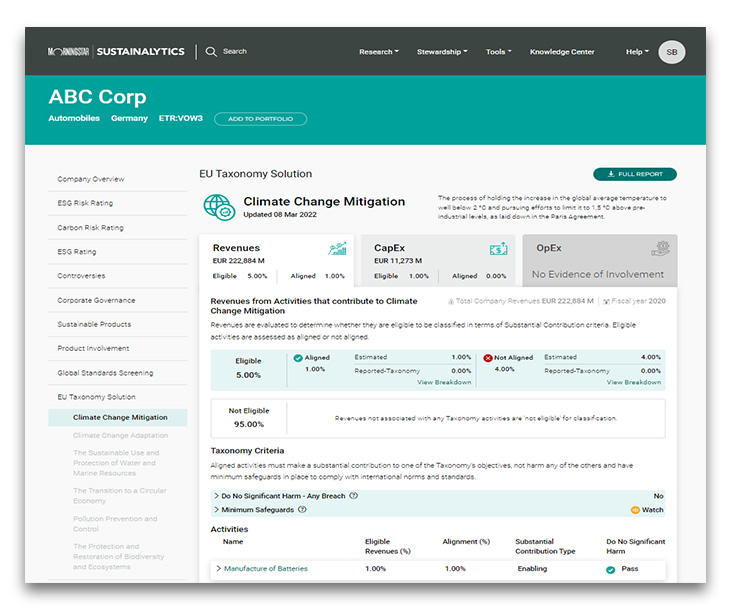

Regulatory Reporting

Regulatory Solutions Reporting

Sustainalytics EU Taxonomy Solution includes taxonomy eligibility and taxonomy alignment assessments. EU Taxonomy-alignment company overviews in Global Access provide intuitive on-screen issuer level reporting, granular insights in each issuer’s involvement in taxonomy eligible activities, substantial contribution, DNSH and minimum safeguards.

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.

Related Insights and Resources

Additional Ways to Access our Research

API & Datafeed Solutions

Integrate our research directly into your systems and work processes through a variety of data deliverables.

Partner Platforms

Access Sustainalytics’ research through various partner platforms with dedicated functionalities, including Morningstar Direct, Bloomberg, Aladdin, RIMES, Markit, Factset & Style Analytics.