The world’s leading corporations, lenders and banks rely on our ESG Risk Ratings to identify and understand the financially material ESG issues (MEIs) that can affect their organization’s long-term performance.

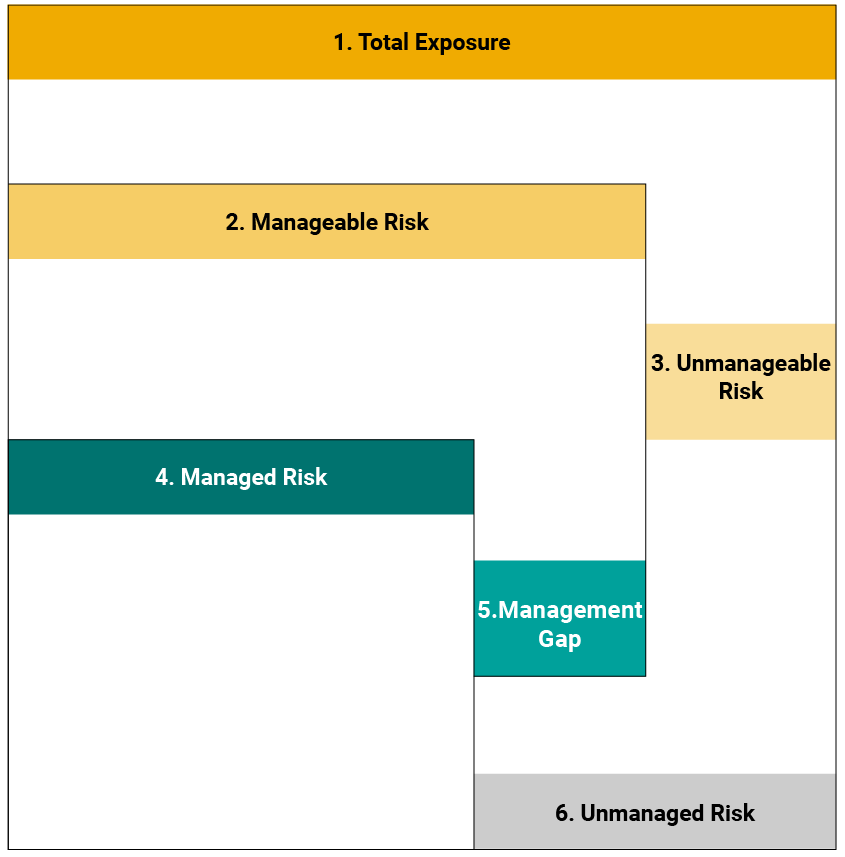

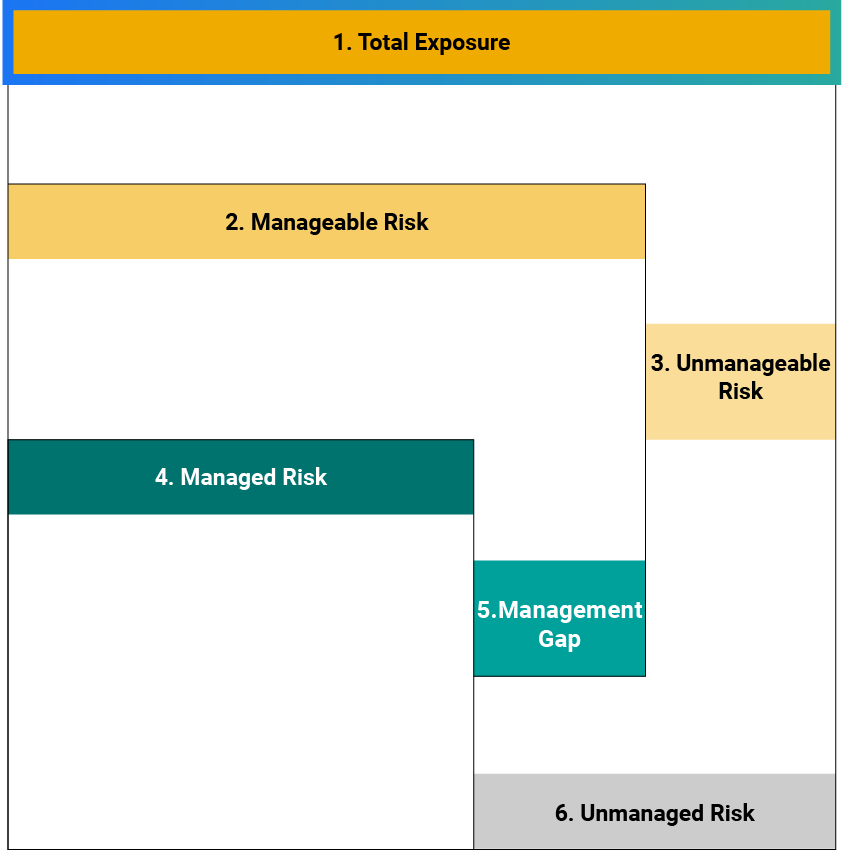

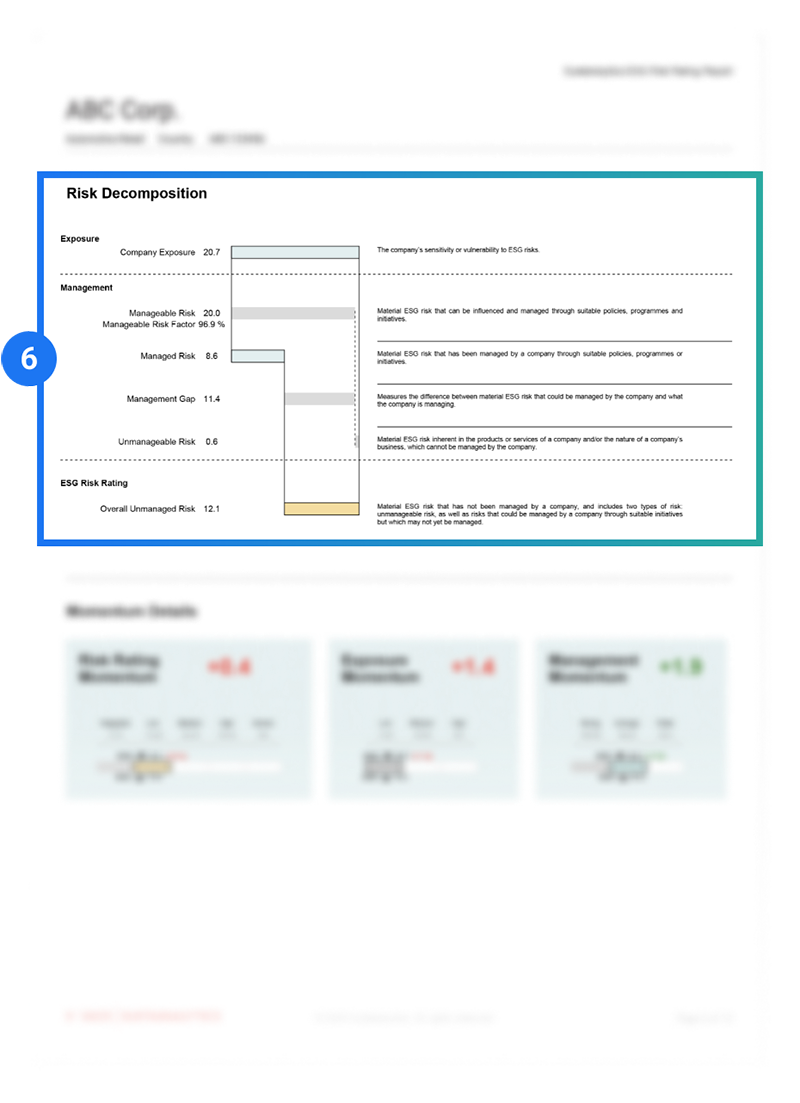

Morningstar Sustainalytics' ESG Risk Ratings provides a multi-dimensional assessment of a company's exposure to industry-specific material ESG risks and its management of those risks. Our transparent methodology categorizes risks into five severity levels, offering an absolute measure of risk.

About ESG Risk Ratings

What are the ESG Risk Ratings?

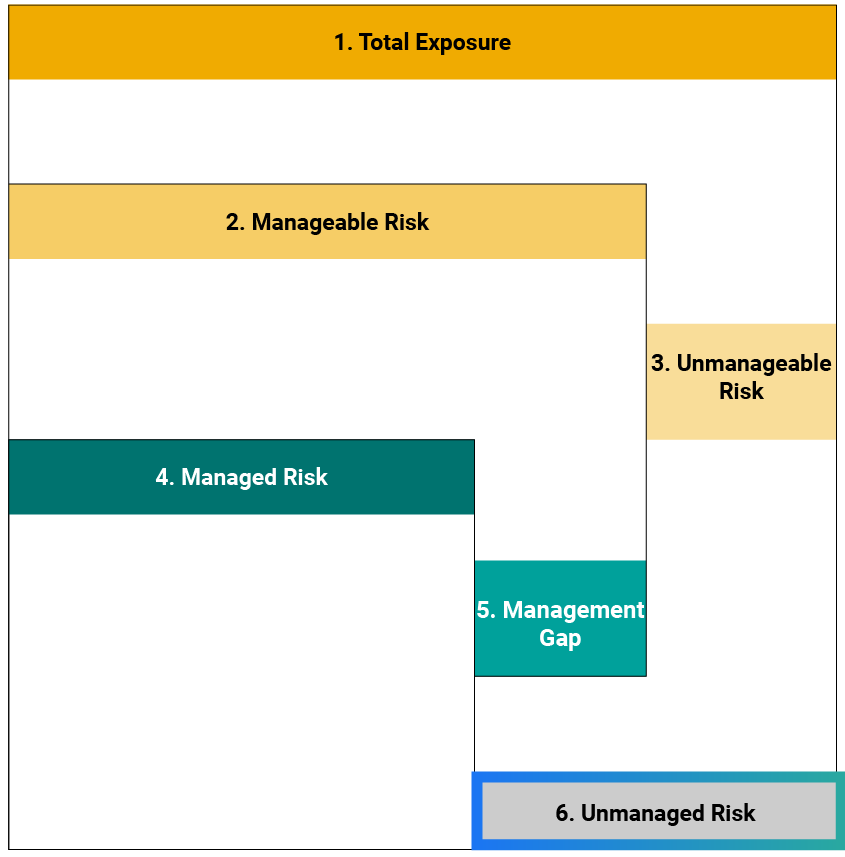

How do the ESG Risk Ratings work?

What are Material ESG Issues?

Morningstar Sustainalytics is a trusted and reliable choice for investors who are looking for a streamlined methodology in assessing financially material ESG issues.

Key Features

Extensive Coverage

With 16,000+ companies covered, encompassing major global indices for a comprehensive research universe.

Five Risk Levels

Categorized from negligible to severe, providing a clear understanding of potential impact.

Benchmark Your ESG Performance

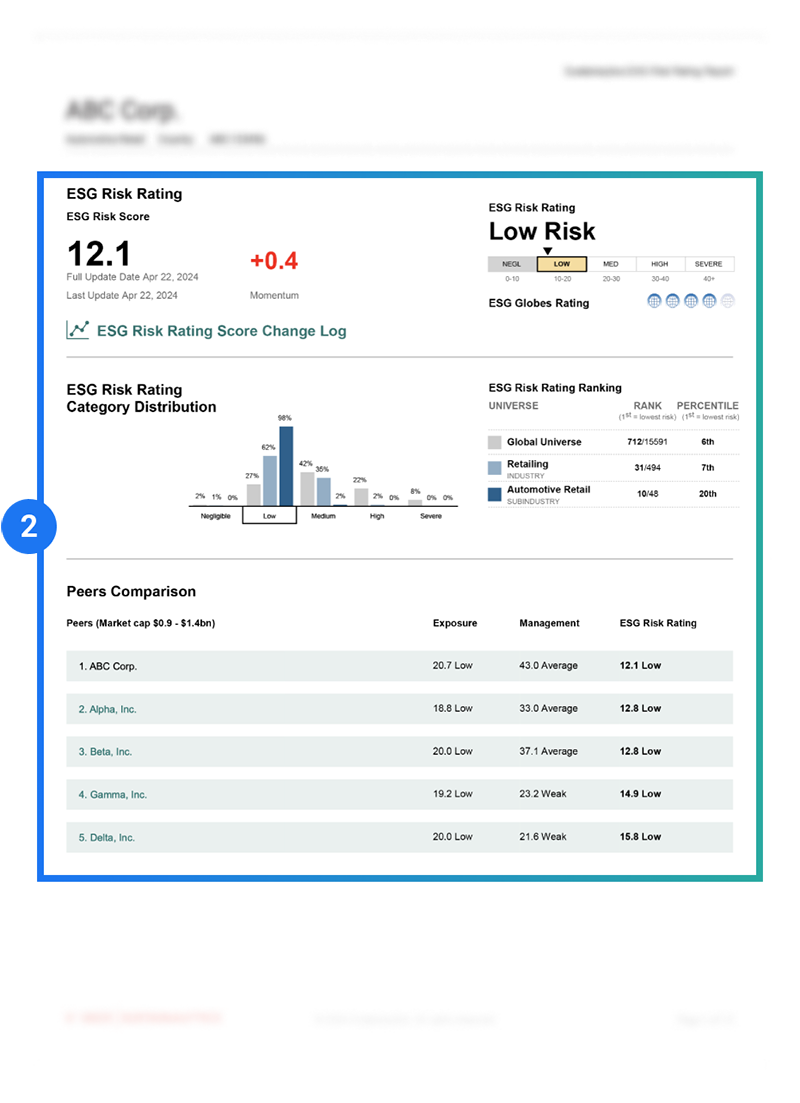

Our Peer Performance suite of products measure ESG Risk Ratings against industry peers to help make informed ESG decisions.

20+ Material ESG Issues

Supported by over 200 indicators and over 1,00 data points.

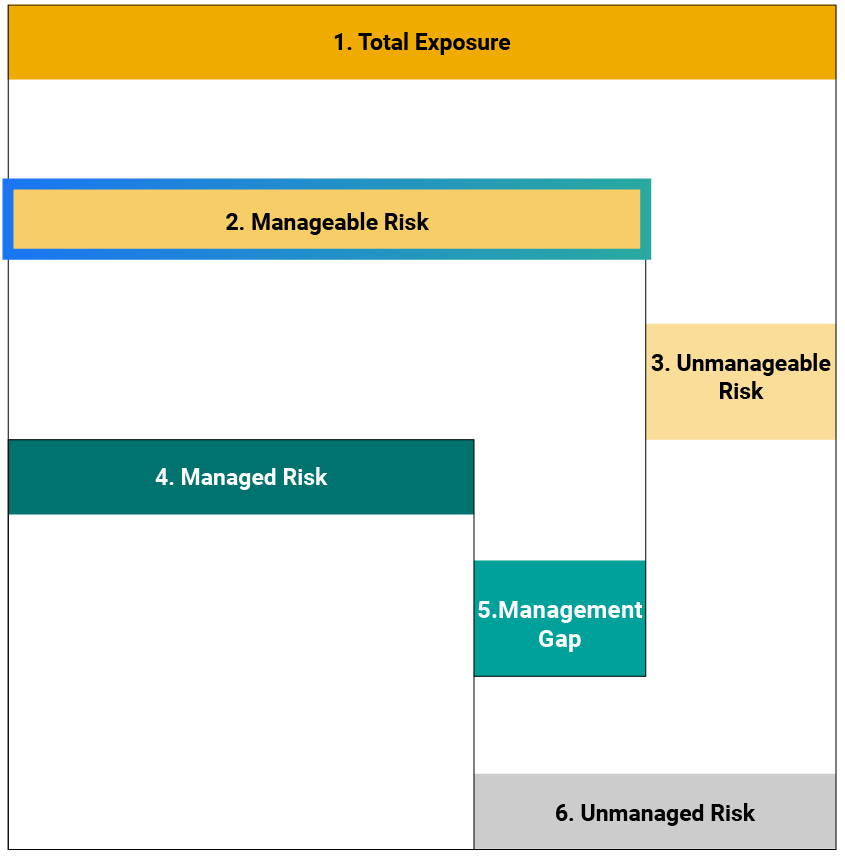

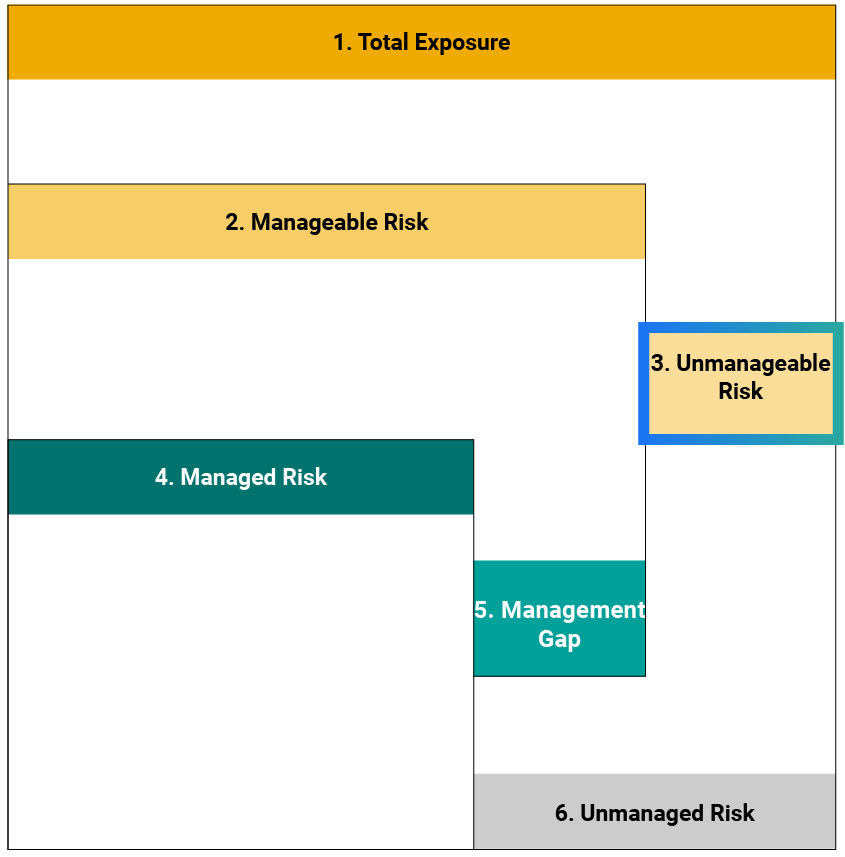

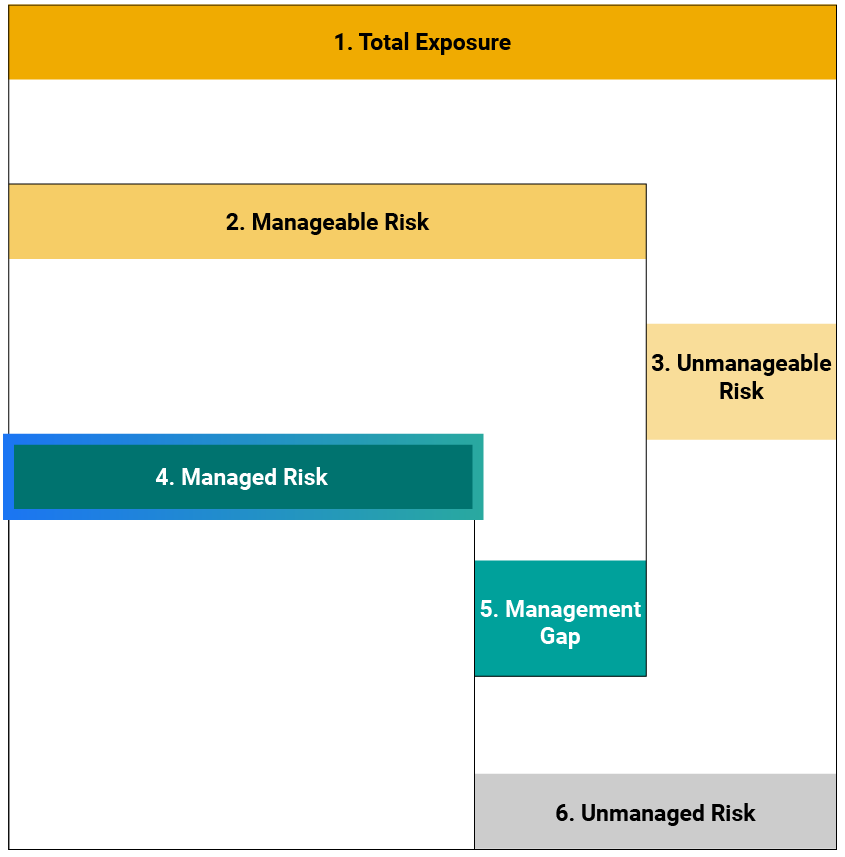

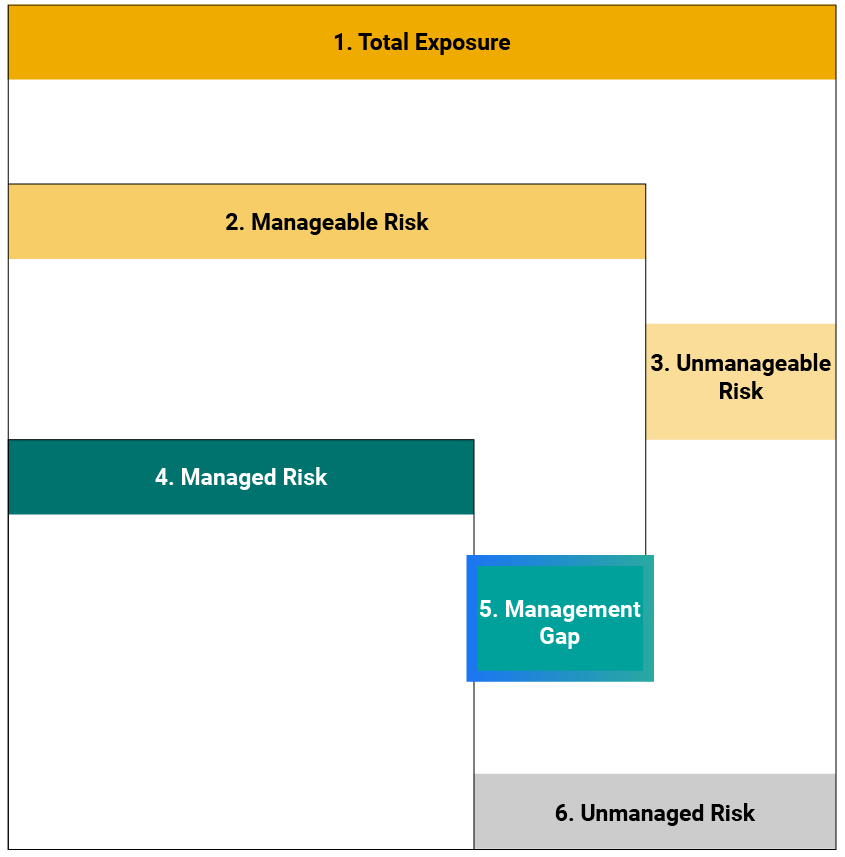

Two-Dimensional Materiality Framework

Measures exposure and management of over 20 industry-specific material risks, supported by over 200 indicators and over 1,800 data points.

Three Central Building Blocks

Corporate governance, material ESG issues, and idiosyncratic issues form the core of our research and ratings.

Absolute Measure of Risk

Allows for easy peer and subindustry comparisons, simplifying portfolio-level aggregation.

Flexible Accessibility

Available through Global Access, Datafeeds, API, and third-party distribution platforms.

Framework

Ready for Informed Decisions

Use Cases

Banking Solutions

Banks and lenders can use our ESG Risk Ratings and data as a part of a broader analysis of their clients as well as for innovative product solutions such as sustainability-linked loans.

Buyer Supply Chain

Share the company’s ESG Risk Rating with buyer(s) looking for greater insight into the sustainability of their supply chain.

Internal ESG performance

Analyze your company’s ESG performance to determine areas of improvement and compare your score to industry peers. Identify areas of improvement and tie them to management or board renumeration.

Investor Relations

Leverage your company’s ESG Risk Rating to support capital raising activities such as the issuance of green, social, or sustainability bonds.

Sustainable Financing

Leverage your company’s ESG Risk Rating to access favorable rates for sustainability-linked loans or issue sustainability-linked bonds.

Marketing and Promotional

Raise awareness about your company’s ESG performance among internal and external stakeholders to help support your organization’s marketing and public statements.

Report Insights

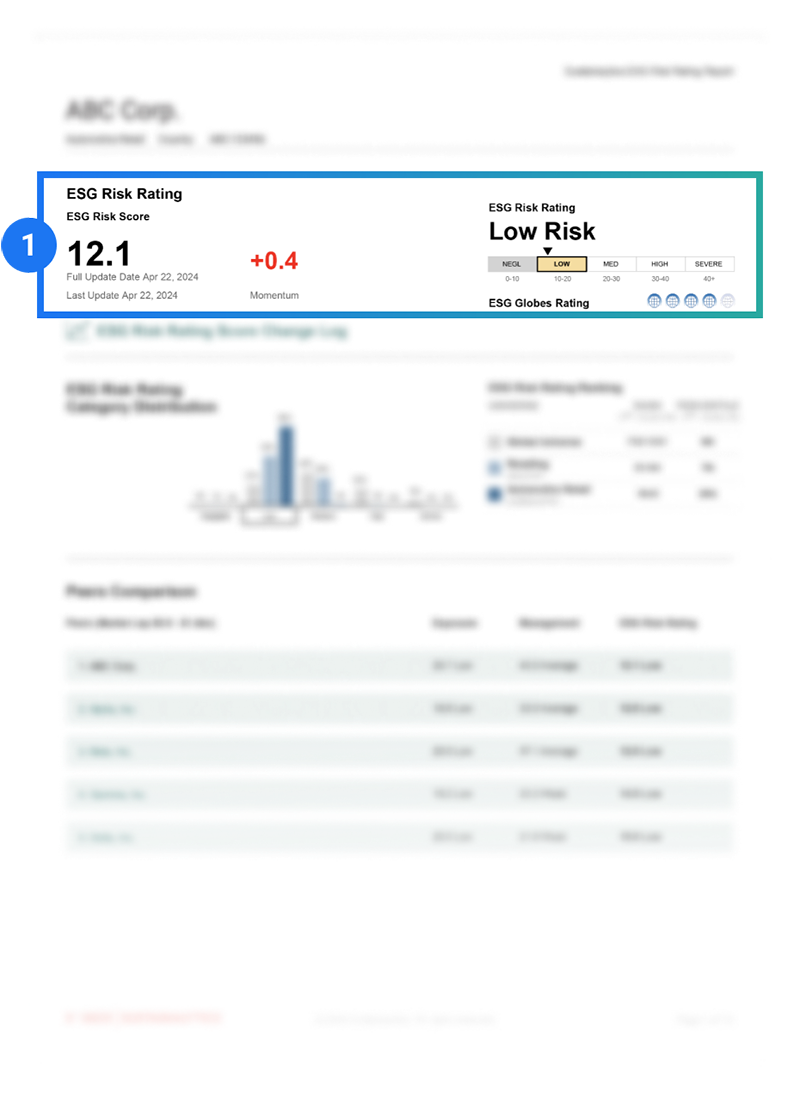

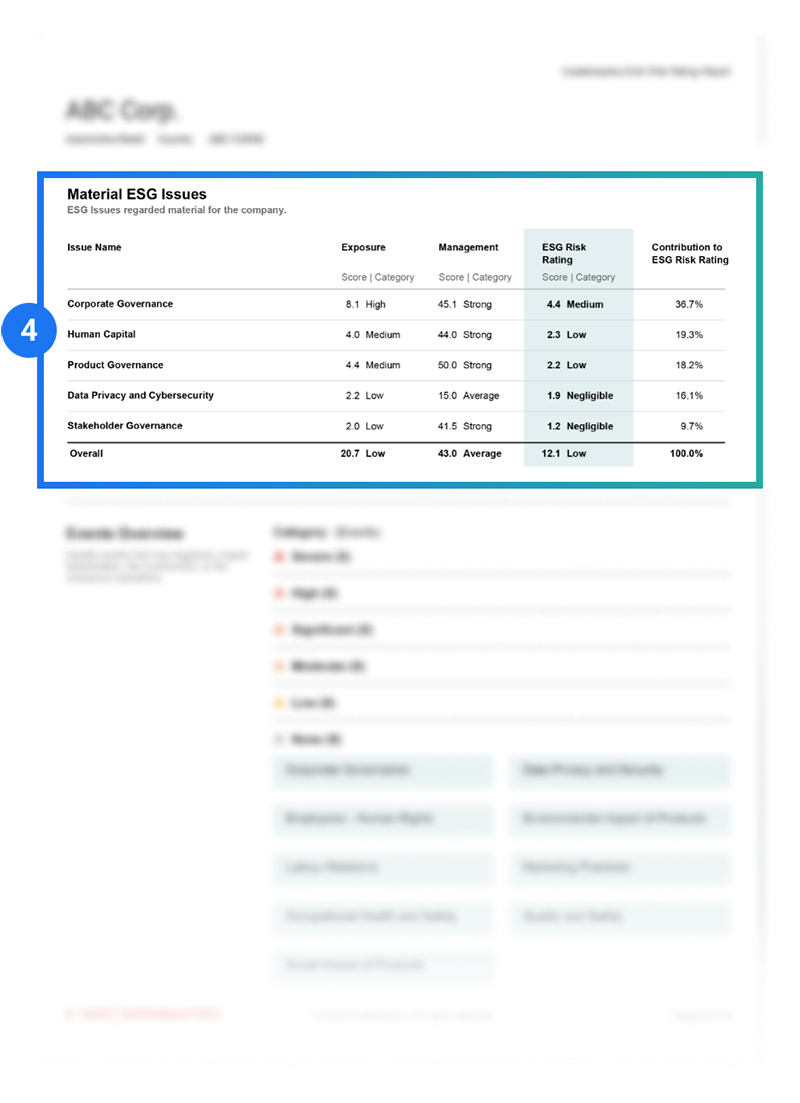

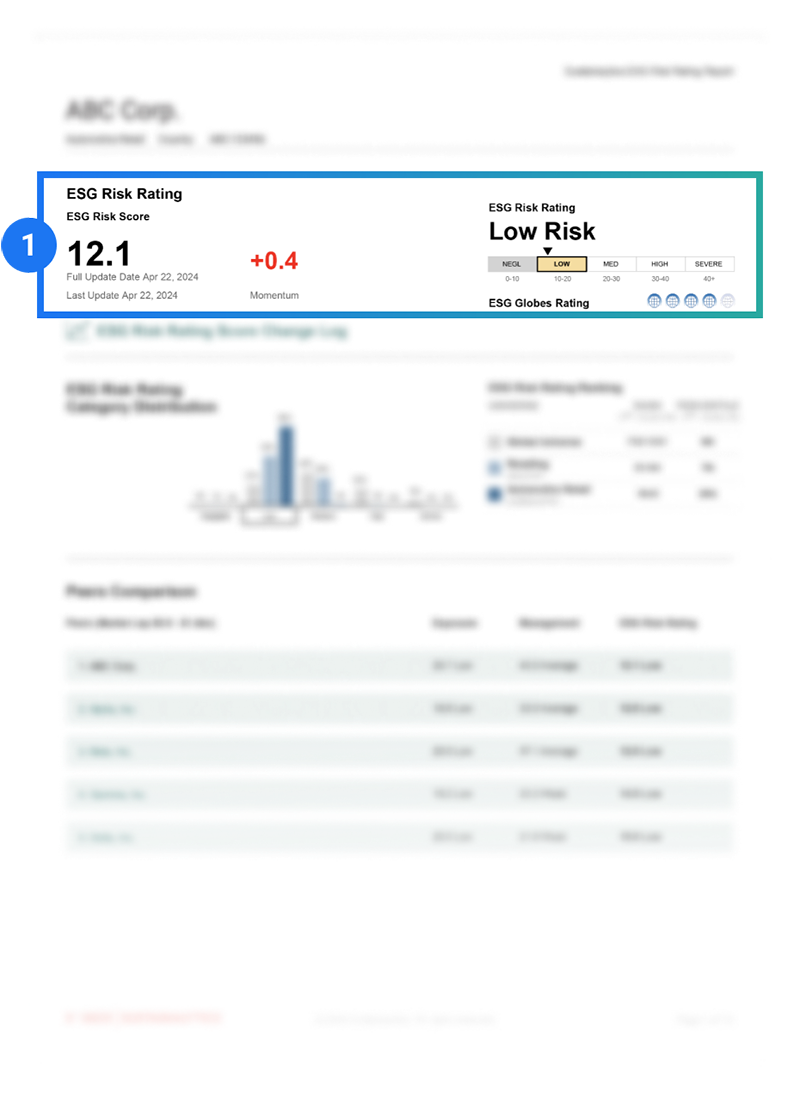

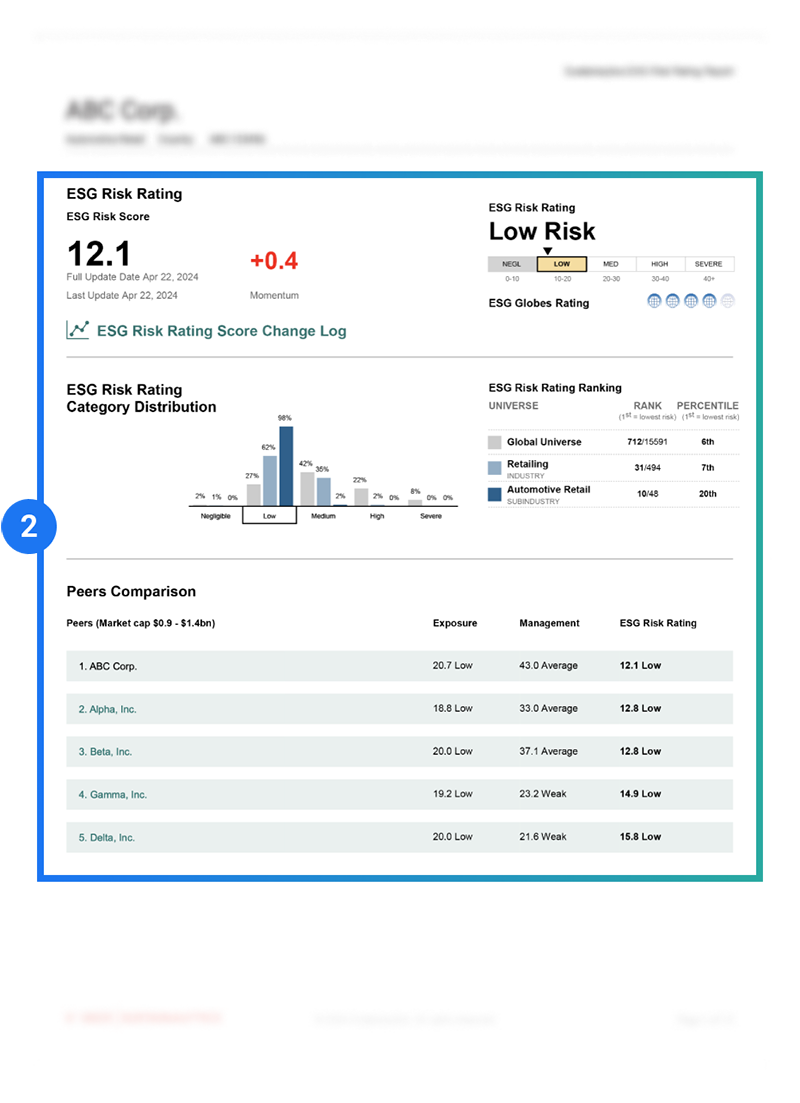

Company ratings are categorized across five risk levels: negligible, low, medium, high, and severe and represented by our ESG Globes icons.

A company’s risk is measured against its industry peers and against the global universe.

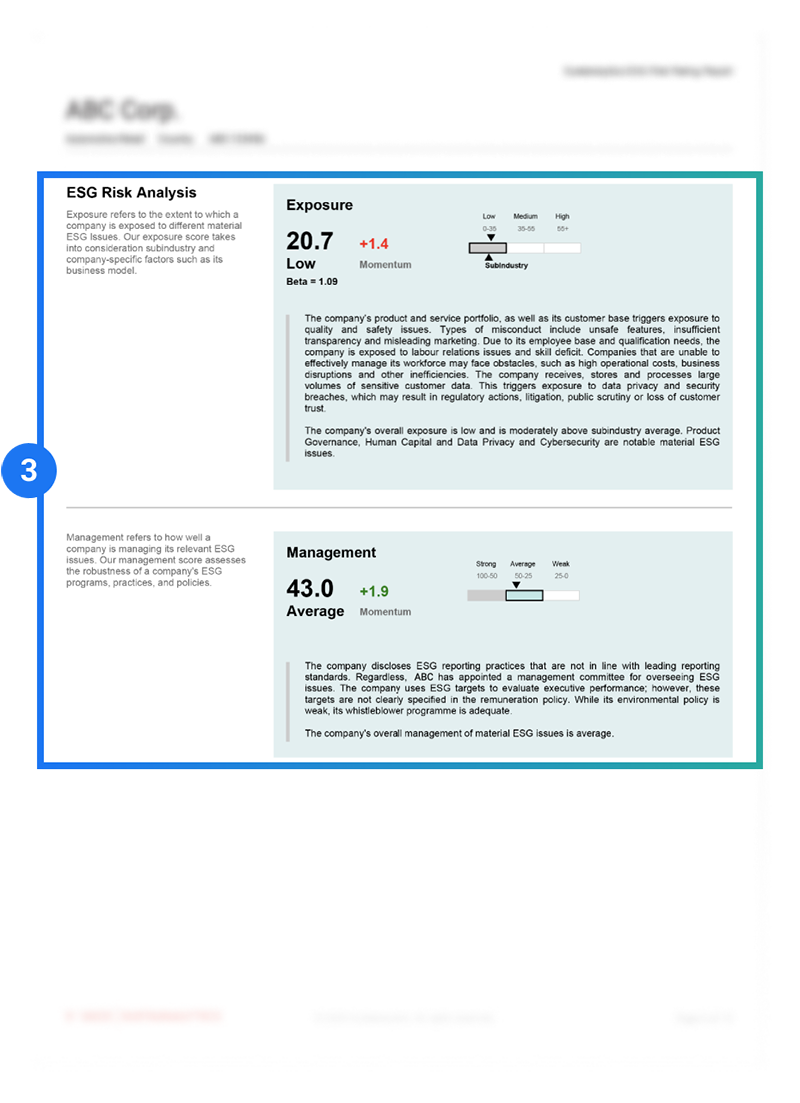

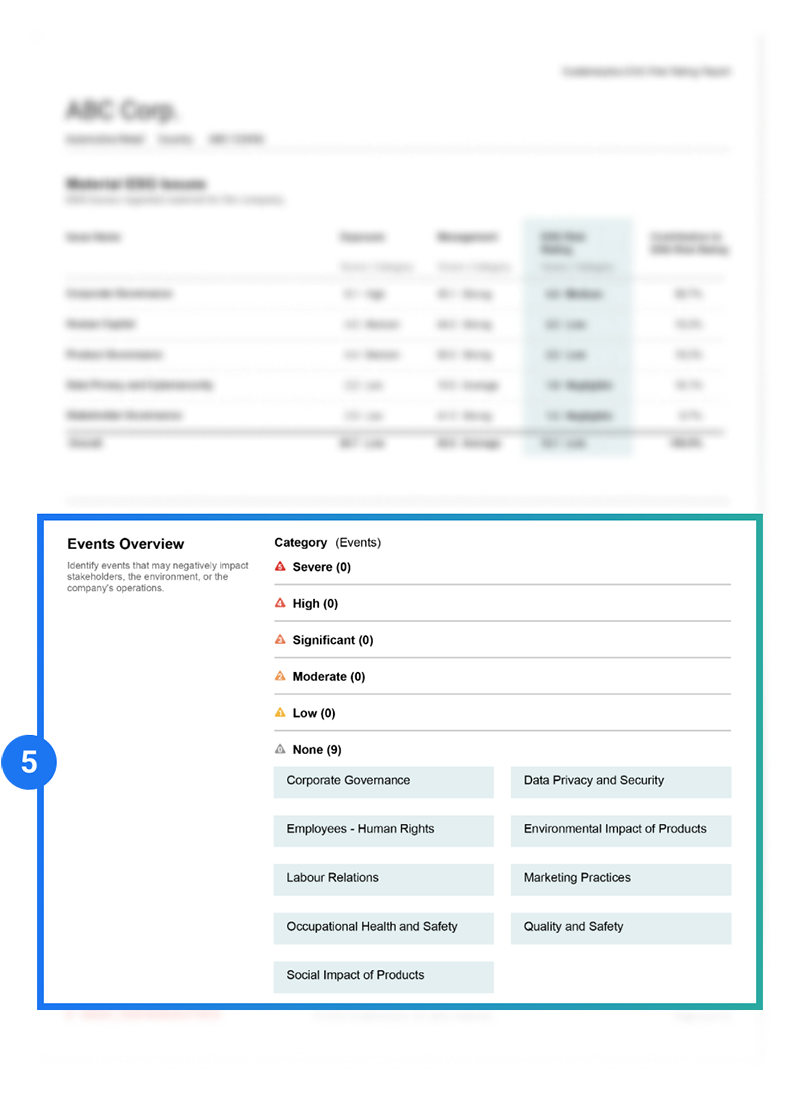

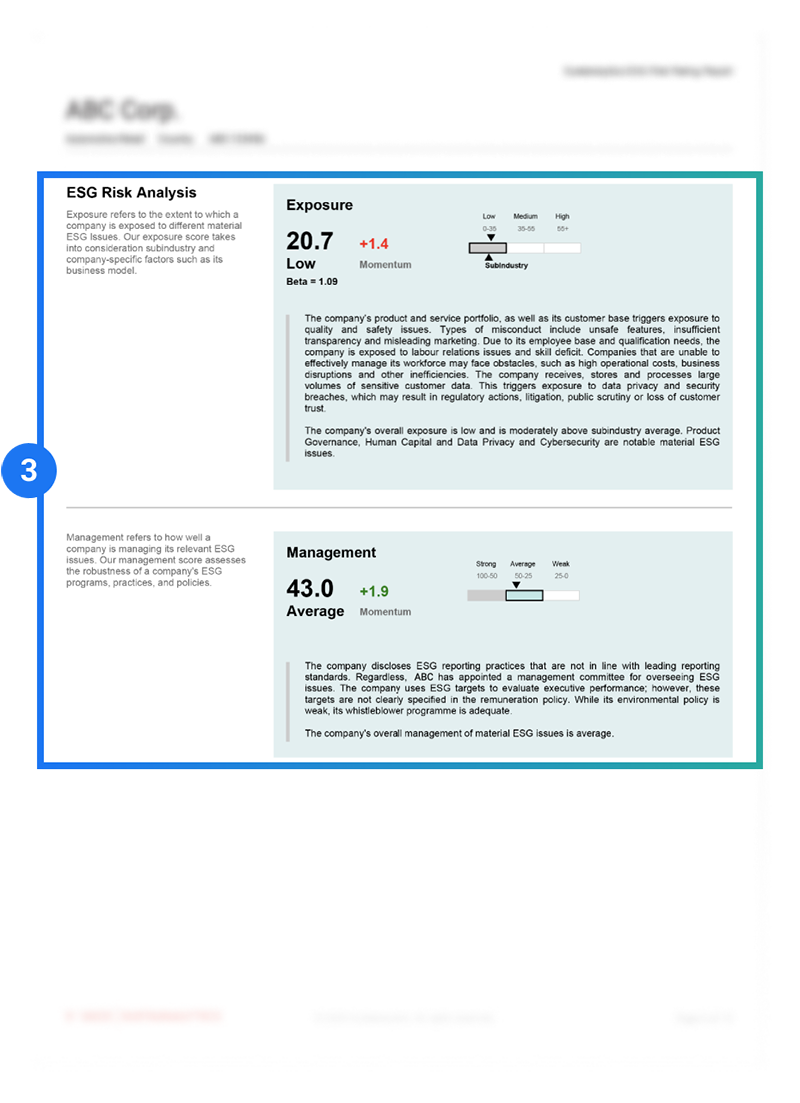

Qualitative analysis, underpinned by analyst insights and quantitative data, describes the reasons why a company is exposed to specific material ESG issues and explains how well a company is managing these issues.

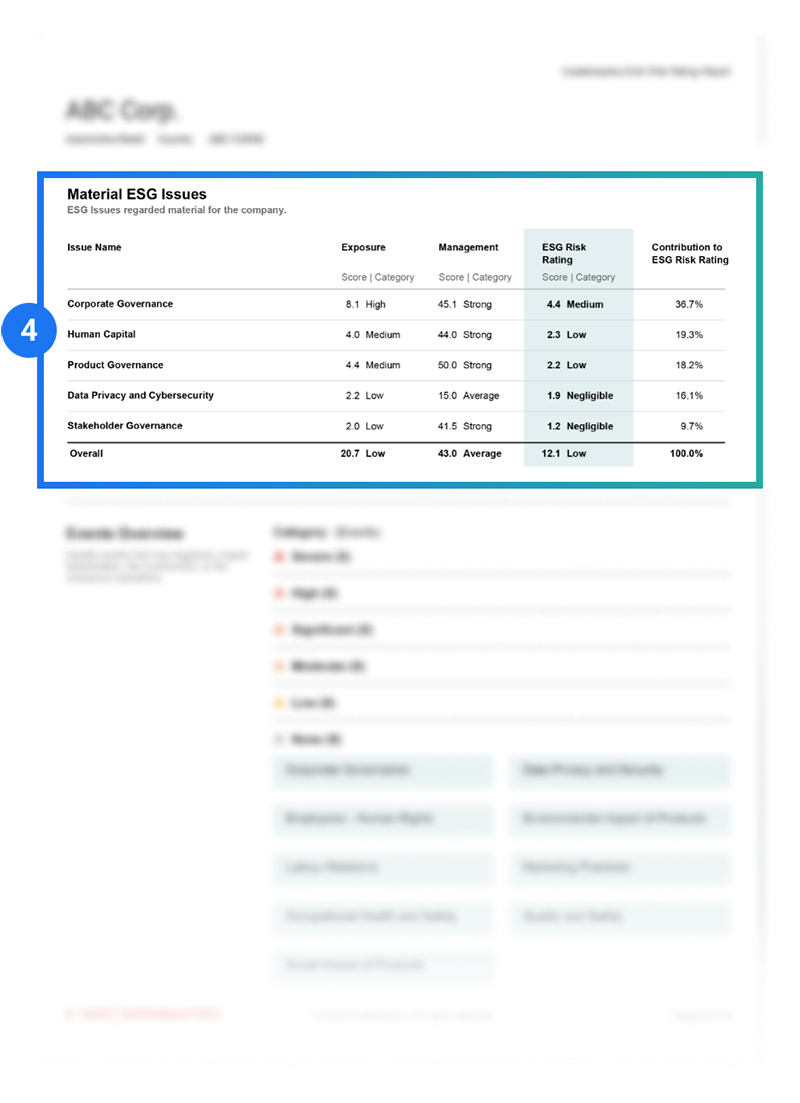

Material ESG Issues (MEIs) are identified and brought into focus.

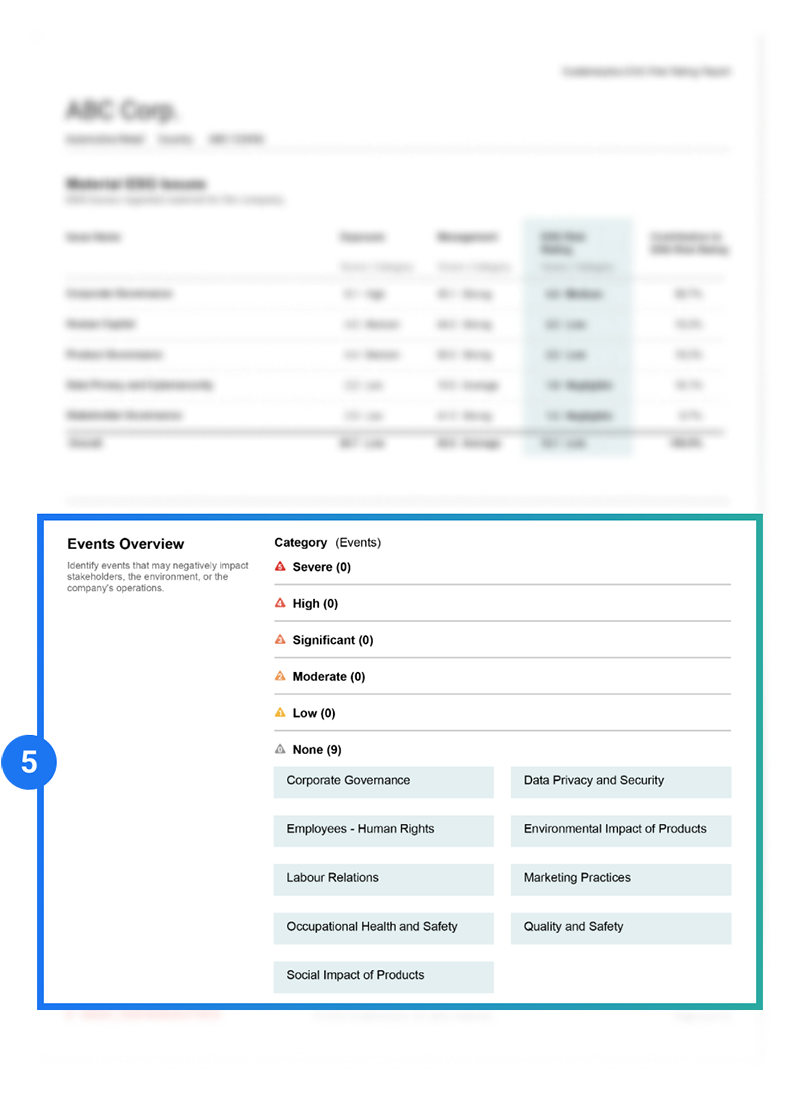

Transparency into company events that may impact a company’s operations, stakeholders or the environment.

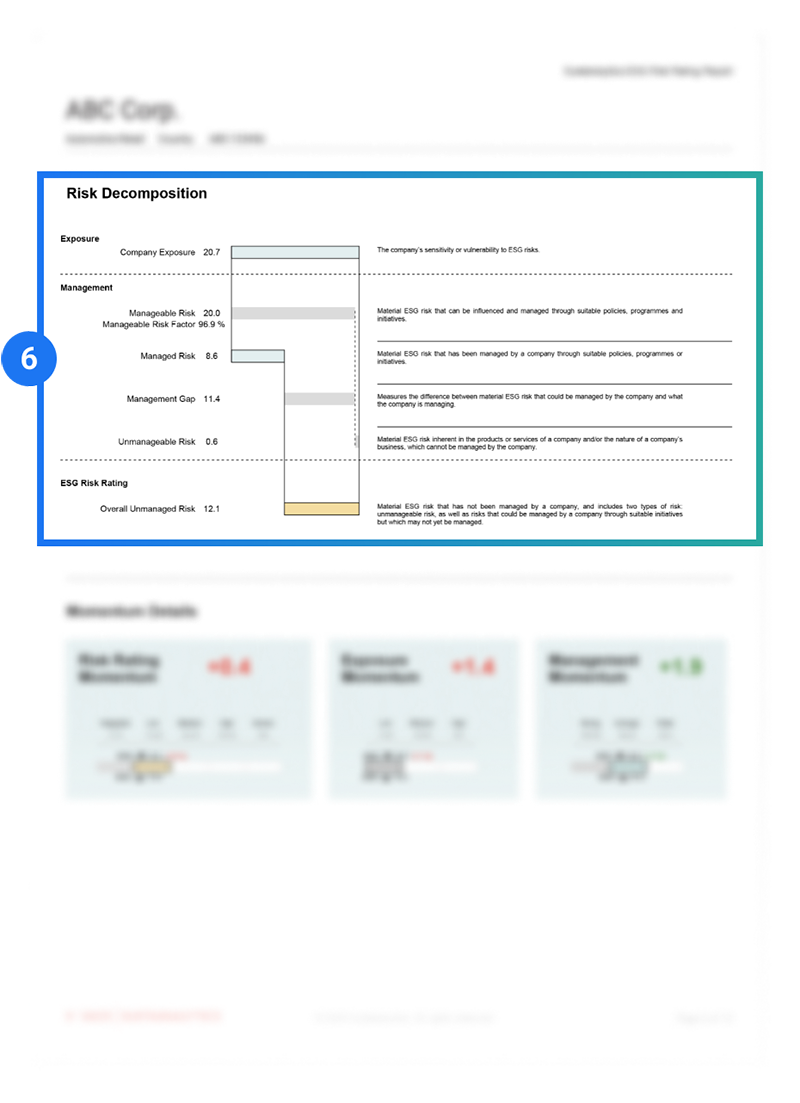

The magnitude to which a company is exposed to ESG risk and how well the company is managing that risk is measured and explained.

Discover how to get your company started with ESG, from developing and implementing a plan, to measuring and communicating progress.

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.

Related Insights and Resources

Reducing Emissions Through Sustainable Finance: A Guide for Companies in Carbon Intensive Industries

This corporate guide discusses the difficulties in measuring, reporting, and reducing GHG emissions in hard-to-abate sectors and provides key takeaways so that companies can take advantage of the opportunities sustainable finance offers.

Risk and Opportunity in Biodiversity: How Sustainable Finance Can Help

This article outlines how biodiversity loss poses material risks to business and how it connects to many other issues that companies can’t ignore. In addition, it covers how biodiversity conservation presents substantial economic opportunities, and how businesses can address and access these opportunities by issuing linked instruments that integrate biodiversity considerations.

Today’s Sustainable Bond Market: Boosting Confidence in Sustainable Bond Issuances

In this article, we examine the kinds of sustainable bonds offered in the market, some of the key regulations being developed in different markets and the current initiatives to improve the quality and credibility of issuances.

Related Products

ESG Licenses

Use Sustainalytics’ ESG Risk Rating for marketing & promotion, sustainability-linked loans, and more.

Second-Party Opinions

Get a second-party opinion on your ESG bond framework from the world's largest provider.

Learn More