On World Water Day, we reflect on global companies’ dedicated attention to this most vital resource. Water risks are related to nine of the top ten worst global risks in the Global Risk Report published by the World Economic Forum

1, with risks likely to increase due to climate change. As global water resources contend with increased stress, companies are expected

to face growing scrutiny of their water use due to the significant impacts that it can have on resource security and the health of ecosystems. This scrutiny may manifest in business risk, including limits placed on water

withdrawal, increasing costs and heightened regulations. Surprisingly, many companies worldwide fail to report on water withdrawal and water consumption, two key water metrics collected by Sustainalytics:

Water withdrawal is the total volume of water withdrawn or diverted by the entity company, regardless of whether it was consumed or returned to its source.

Water consumption is the total volume of water withdrawn and consumed by a company for its own purposes and not returned to the source from where it withdrew it.

Very Few Companies Report on Water Metrics

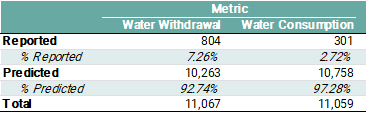

Overall, more companies disclose on water withdrawal than on water consumption, as noted in Exhibit 1. Less than 7% of companies covered in Sustainalytics’ research universe report on water withdrawal and less than 3% of companies report on water consumption. Considering the limited disclosure, Sustainalytics developed a proprietary multi-factor regression model to predict the water withdrawal and water consumption for companies that do not yet report such data.

Exhibit 1: FY2019 Water Withdrawal and Water Consumption

Source: Sustainalytics

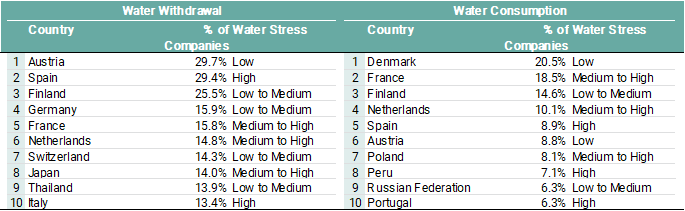

European Companies Lead in Reporting

The top 10 countries for reporting on both metrics are primarily European. This is likely credited to the stricter regional environmental standards and guidelines (e.g. European Union's Non-Financial Reporting Directive). According to the World Resources Institute, Austria and Denmark, which are considered to have low water risk, are noted for having companies most likely to report on water withdrawal and water consumption, respectively.

Exhibit 2: Top 10 - Corporate Reporting on Water Withdrawal and Consumption, by Headquarters

* The percentages are calculated as a proportion of total number of companies in a given country as per Sustainalytics research universe.

**Countries with less than 20 companies in Sustainalytics research universe are excluded from this analysis.

Source: Sustainalytics, WRI Aqueduct 2030 BAU Scenarioii

Two Asian countries, Japan and Thailand, are also among the leaders in companies that report on water withdrawal. Both are noted for having regions within the country that have periodically suffered under drought.

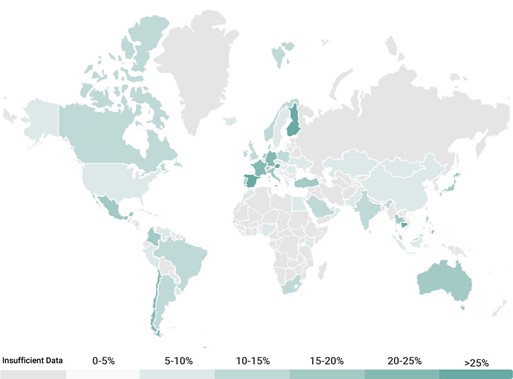

Exhibit 3: Map of Percentage of Companies Reporting on Water Withdrawal, by Headquarters

Source: Sustainalytics

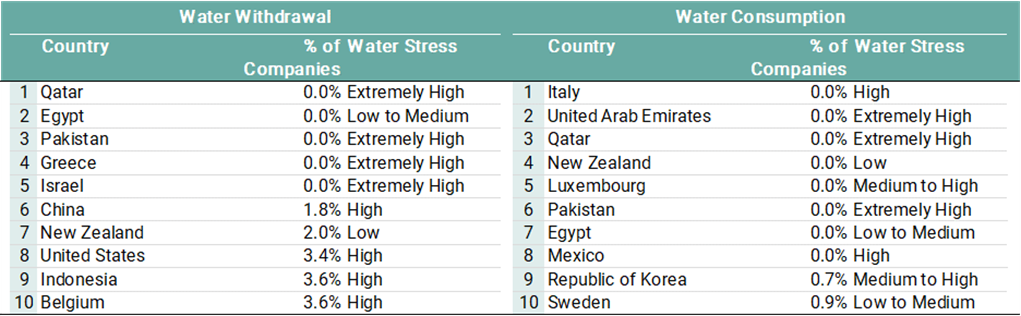

Although Japanese and Thai companies are believed to report at higher levels due to their sensitivity to water risks, a look at the ten bottom-ranked countries paints a different picture. Countries with some of the most significant water stress levels, including Pakistan, Qatar, and the United Arab Emirates, do not have any companies within Sustainalytics’ research universe that report on key water metrics. China and the United States are among the countries where companies are least likely to report on water withdrawal. This is especially concerning considering that they are the world’s two largest economies, with a significant ability to influence global corporate behavioural norms. Furthermore, both China and the United States face high water stress.

Exhibit 3: Bottom 10 - Corporate Reporting on Water Withdrawal and Consumption, by Headquarters

* The percentages are calculated as a proportion of total number of companies in a given country as per Sustainalytics research universe.

**Countries with less than 20 companies in Sustainalytics research universe are excluded from this analysis.

Source: Sustainalytics, WRI Aqueduct 2030 BAU Scenarioiii

As we look to a future with increased global water risks, a lack of reporting on water metrics indicates a significant disconnect between the risks companies face and their actions. Better measurement and disclosure on water metrics in all countries will allow issuers and investors to identify critical areas of risk and ensure actions are taken to limit those risks.

To learn more about Sustainalytics’ Impact Metrics, including water withdrawal and water consumption, please get in touch with our Client Advisory team.

[1] World Economic Forum (2021); “The Global Risks Report 2021: 16th Edition”; World Economic Forum, accessed (05.03.2021) at: http://www3.weforum.org/docs/WEF_The_Global_Risks_Report_2021.pdf

[2] www.wri.org (2021); Aqueduct Projected Water Stress Country Rankings, accessed (07.03.2020) at: https://www.wri.org/resources/data-sets/aqueduct-projected-water-stress-country-rankings

[3] www.wri.org (2021); Aqueduct Projected Water Stress Country Rankings, accessed (07.03.2020) at: https://www.wri.org/resources/data-sets/aqueduct-projected-water-stress-country-rankings

.tmb-thumbnl_rc.png?Culture=en&sfvrsn=12471767_1)