|

|

|

|

Global Military Spending on the Rise, Led by Europe

Amid the current geopolitical shifts, defense and security have moved to the forefront of all political and strategic international discussions. The need to invest in security is growing, and Europe is not alone in adopting this strategic approach. In 2024, over 100 countries, including several in Asia and the Middle East, increased their military spending.1 In June 2025, NATO members agreed to bolster their public expenditure on defense from 2% to 5% of their gross domestic product. Meanwhile, the European Union (EU) adopted the Defence Readiness Omnibus package,2 aimed at streamlining regulatory, financial, and operational procedures across the defense sector. This initiative could mobilize up to EUR 800 billion (USD 945 billion).

In its Defence Omnibus, the European Commission underscores the importance of investing in innovation. It also places strong emphasis on the development of products that have the potential for dual – i.e., civilian and military – use, including technologies powered by artificial intelligence, advanced materials, nanotechnology, biotechnology, satellites, and drones.

Companies of all types and sizes can be involved in a gamut of defense-related activities. However, the commission emphasized that development efforts and funding should support small and medium-scale enterprises (SMEs) in Europe.3 The commission also advises that financing decisions across the sector be informed by a case-by-case assessment approach.

In this article, we examine the opportunity set within the Morningstar Sustainalytics coverage universe for investors and lenders, focusing on companies involved in military contracting. We also explore environmental, social, and governance (ESG) due diligence considerations specific to this sector.

The Existing Opportunity Set

Sustainalytics’ coverage universe of more than 23,000 companies includes around 860 public and private companies that are involved in military contracting.

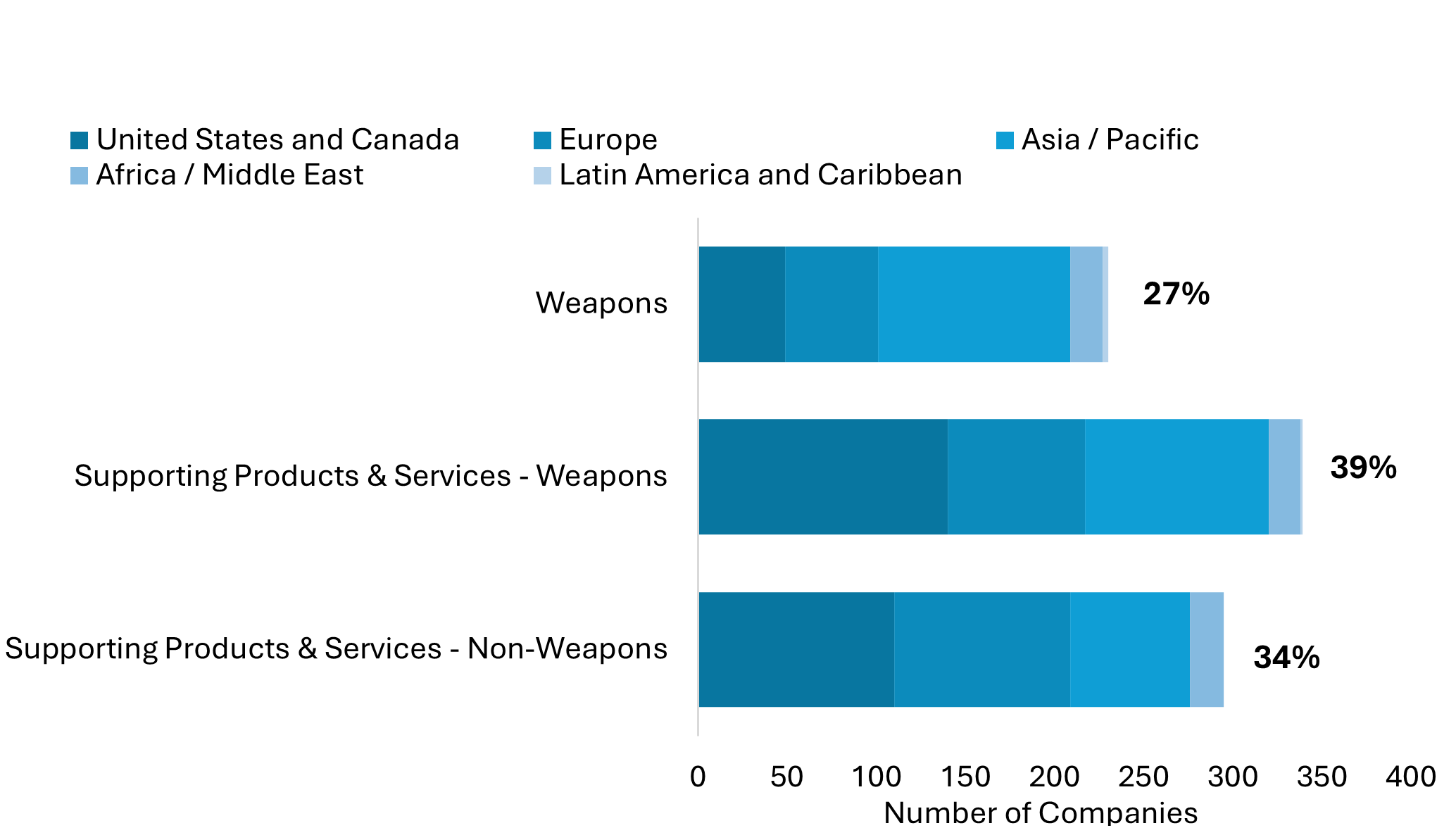

As shown in Figure 1, over one quarter (27%) of these companies are directly involved in manufacturing weapons or tailor-made components of weapons. This category includes bombs, missiles, grenades, mines, jet fighters, attack helicopters, battleships, tanks, and other assault vehicles.

The remaining 73% of companies provide related products and services, which fall into two categories:

- Supporting Products and Services - Weapons (39%). These include equipment, components, and support systems designed or adapted for military use. Examples include landing gear or oxygen systems for jet fighters, fuel cells developed for military applications, and specialized radar or communications systems for aircraft or naval ships.

- Supporting Products and Services - Non-Weapons (34%). These include specialized radar and communications systems, fabrics for bulletproof vests, and data management services for military operations.

Figure 1. Companies Involved in Different Types of Military Contracts

Large US Players Dominate, But More Opportunities for Investors May Emerge in Europe

The US dominates the global defense landscape, and this is reflected in the make-up of the Sustainalytics coverage universe.

Of the 860 companies involved in military contracting that we cover, 299 (35%) are based in the United States or Canada. Asia follows closely with 278 companies (32%), and Europe ranks third with 228 firms (26%). The majority of our universe consists of publicly listed entities, with 18% privately held — primarily based in the US and Europe.

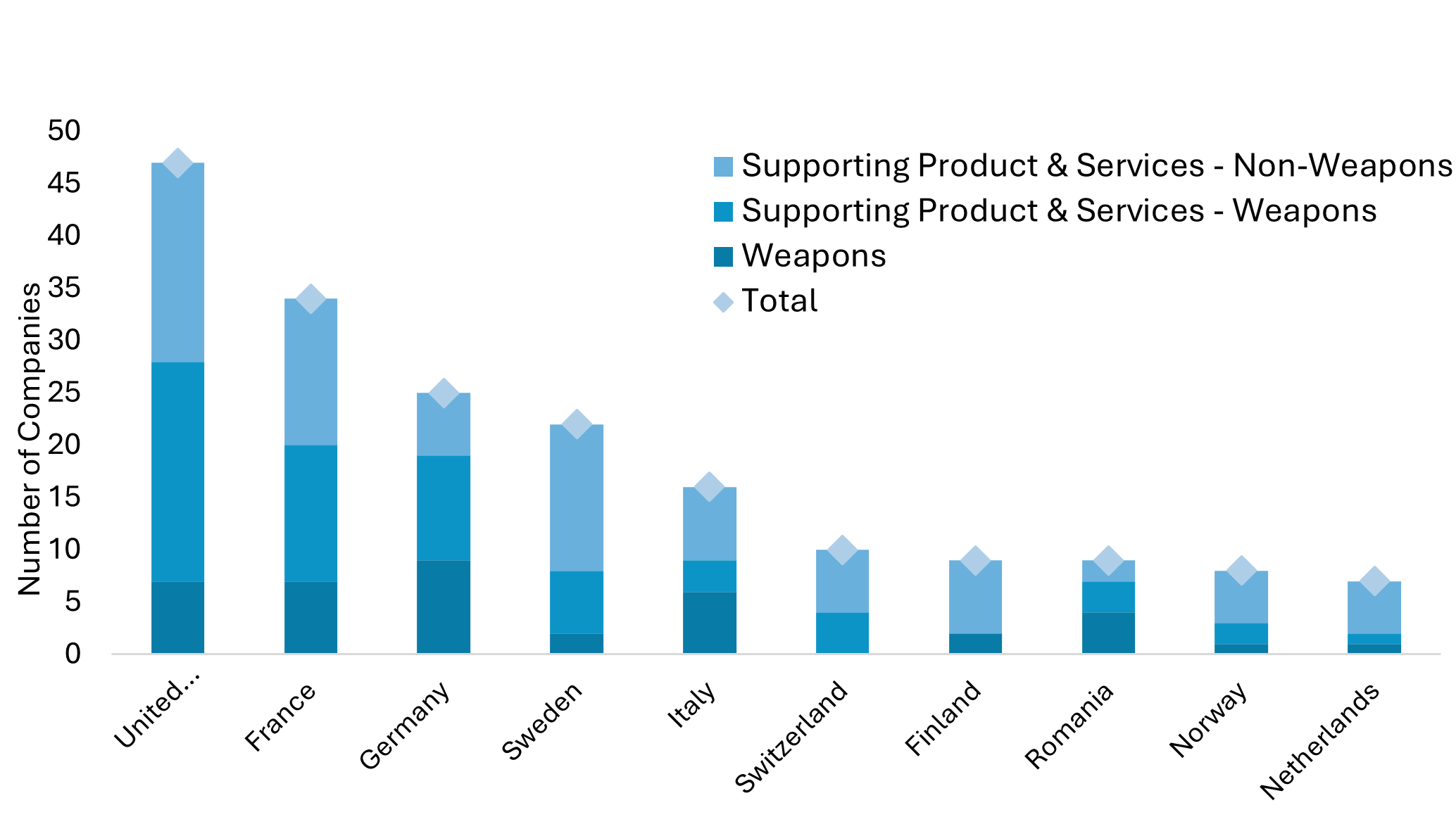

In Europe, the defense sector is concentrated in a few countries — primarily the UK, France, Germany, Sweden, and Italy — and dominated by a small number of large players (see Figure 2). Thales, BAE Systems, and Rheinmetall rank among the region’s largest defence companies, competing directly with US heavyweights such as RTX Corp, Lockheed Martin, and Northrop Grumman.

Figure 2. Regional Spread of Companies With Military Contracts in Europe

Looking ahead, rising defense budgets and targeted EU support for SMEs are expected to accelerate the emergence of innovative European firms and start-ups developing solutions beyond the current product landscape. For investors, this evolving ecosystem presents diversification opportunities within a sector historically dominated by a few large players.

Beyond Aerospace and Defense: A Look at Other Key Industries

A key question for investors seeking exposure to the defense sector is whether to focus on companies with pure-play military contracts or also consider firms with limited involvement or dual-use capabilities (i.e., firms that supply products serving both civilian and military purposes).

The EU Defense Omnibus package encourages innovation and investments in dual-use technologies and materials.4 This opens opportunities for investors to consider companies beyond the traditional aerospace and defense, and machinery industries.

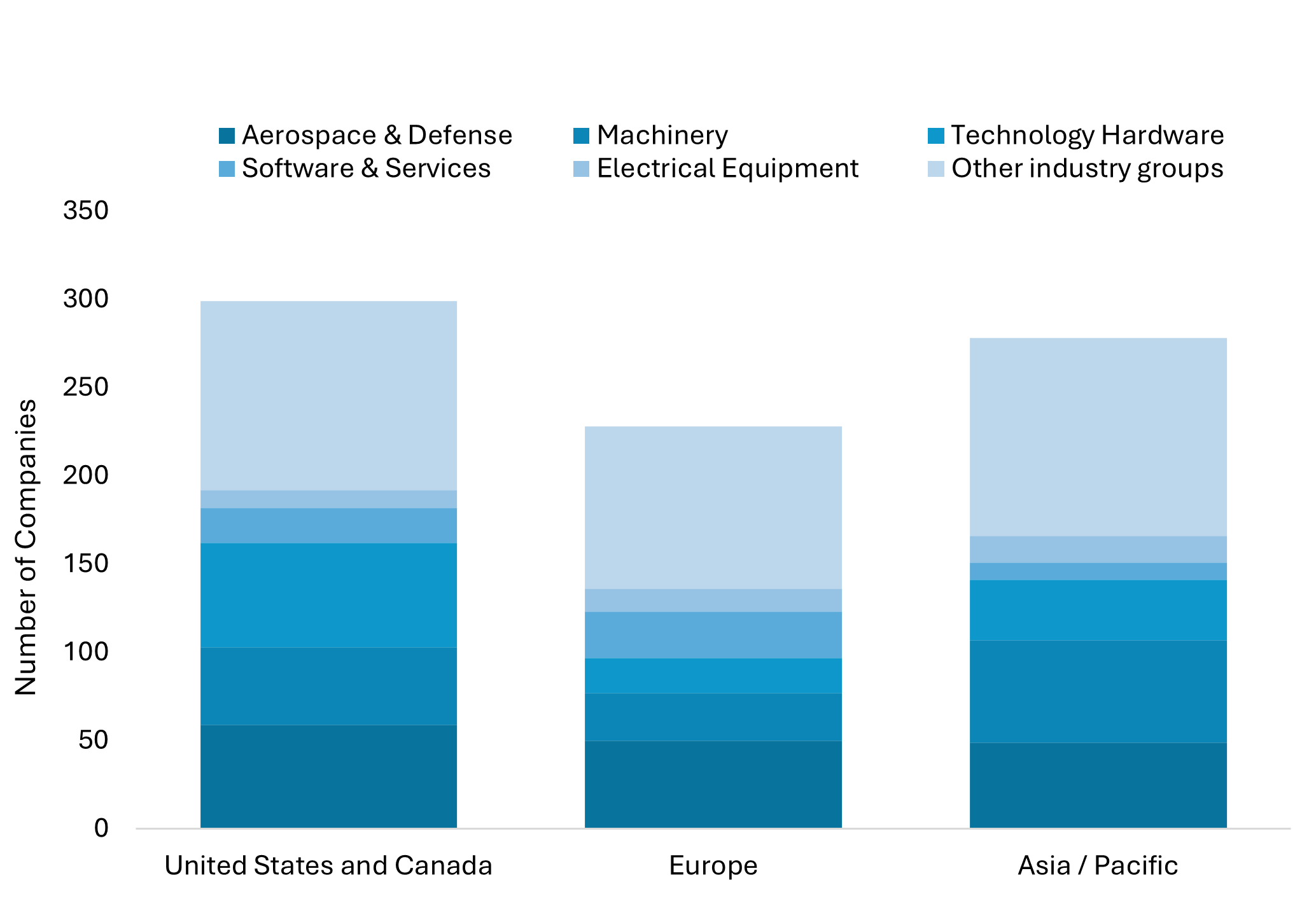

In Figure 3, we show the top industries in which companies with military contracts in our sample operate, split by region. Most companies (287 or 33%) belong to the aerospace and defense or machinery industry. Meanwhile, almost one quarter (207 companies) operate in the technology hardware, electrical equipment, and software services sectors, highlighting the growing role of cross-sector collaboration in the defense space.

Figure 3. Top 5 Sectors of Operation of Companies With Military Contracts

In Europe, an example of military contractors operating outside the traditional aerospace and defense sectors is Fincantieri, a USD 7.7 billion-machinery company based in Italy that manufactures naval defence ships. Within the technology hardware industry group, Norway’s Kitron ASA (USD 1.2 billion market cap as of September 2025) supplies military avionics, communications, control systems, and surveillance technologies.

Sweden’s C.A.G. Group AB (USD 87 million market cap), through its Novus subsidiary, provides software services such as integrated logistics solutions, management systems, and record-keeping for military command and communications. Meanwhile, Germany’s Siemens Energy (USD 84 billion market cap), classified under electrical equipment, offers integrated propulsion drive solutions for submarines through its marine business.

ESG Due Diligence is Key

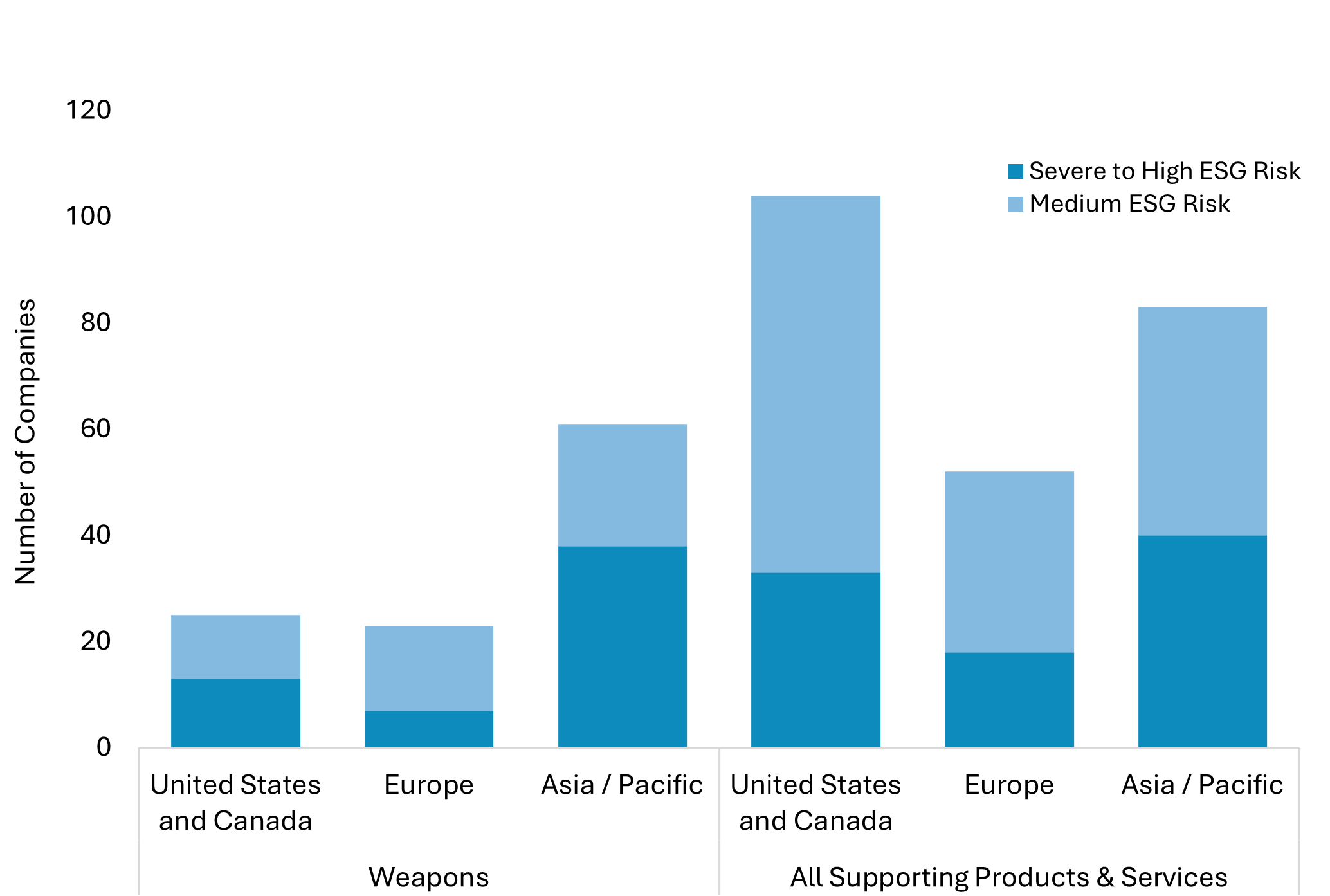

In its Defence Omnibus, the commission clarified that nothing in the regulation currently impedes sustainability-oriented market participants from investing in or financing defense companies. But it encourages a case-by-case approach to inform investment and financing strategies for the sector. This includes ensuring compliance with international treaties and national laws, and relevant risk mitigation measures.5 A case-by-case approach should also incorporate a robust ESG due diligence process, in our view. This is particularly important given that in most regions, a large share of companies with military contracts for weapons are assessed as having high or severe ESG risks, whereas those providing supporting services tend to fall into the medium ESG risk category (see Figure 4).

Figure 4. ESG Risk Rating of Companies With Military Contracts

According to Sustainalytics’ ESG Risk Ratings research, European producers of weapon systems and components tend to manage ESG risks more effectively than those in other regions. Most of these European companies fall into the medium ESG risk category. This can be attributed to the region’s stricter regulations and disclosure requirements.

In contrast, the US and Canada have a higher proportion of companies with high ESG risk, while companies based in China are more often associated with severe risk.

The defense sector faces a broad set of ESG risks, amplified by its concentration in highly regulated markets, close government oversight, and the sensitive nature of its products. Thus, key risks are associated with unethical business practices, product and service quality and safety, energy efficiency, and emissions.

Business Ethics Risks Amplified by Sector Concentration

Ethical misconduct, whether through corruption, unfair procurement, regulatory breaches, or pricing abuses, is a central risk in defense.

High exposure to anti-competitive practices stems from the significant consolidation of the defense sector over the last four decades, which has resulted in a few dominant players (often with established government ties) bidding for a limited number of high-value contracts.

As global demand for defense products surges, the sector risks becoming even more concentrated. This concentration raises persistent business ethics concerns, including questions about arms exports, human rights violations, and transparency in procurement.

Ensuring Quality and Safety of Products and Services

Due to the inherently high-risk nature of their products, defense companies are also exposed to key ESG concerns such as quality and safety. Operating in a high-stakes environment, these firms face strong regulatory pressure — particularly in the US and the EU — to comply with stringent safety standards.

Failures in this area can lead to substantial financial losses from operational disruptions, recalls, and client reimbursements. Moreover, during periods of surging demand, companies may rush to scale production, which can strain product management systems and result in quality issues, skipped compliance steps, or missing documentation — risks that are especially acute for firms lacking robust quality assurance programs.

Rising Emissions — A Need for Improved Energy Efficiency

Defense companies contribute significantly to environmental degradation through their energy-intensive manufacturing processes (scope 1 and 2), and additional emissions throughout their supply chains (scope 3 upstream). Defense companies also emit carbon through the deployment of products with a heavy carbon footprint such as tanks, fighter jets, warships, and missiles. This stage (scope 3 downstream) can account for more than 90% of a company’s total environmental footprint.6

The total military carbon footprint is estimated to exceed 5% of global emissions,7 a figure likely to rise due to increasing military budgets. While defense firms may not face the same decarbonization pressure as civil aviation, their government clients have strong incentives to reduce fossil fuel consumption to cut costs and improve operational efficiency.

As a result, demand for more fuel-efficient products is growing. Yet, despite increased investments in advanced technologies, industry players are generally lagging in the commercialization of greener alternatives, constrained by low returns on investment and the long timelines required to bring such innovations to market.

Table 1. Summary of Key ESG Risks in the Defense Sector

| Category | Key ESG Risk Factors | Illustrative Examples |

| Business Ethics | Corruption, unfair procurement, regulatory breaches, market dominance abuses | Industry consolidation leading to a few dominant players with government ties; limited competition for high-value contracts. |

| Product Quality & Safety | Compliance failures, delays and overruns, technical malfunctions | Operational disruptions, recalls, client reimbursements; rising demand/production puts pressure on quality assurance. |

| Environmental Impact | High emissions from manufacturing and product use | Scope 1 & 2: energy-intensive production processes; scope 3 downstream: over 90% of total footprint; growing regulatory and policy push to decarbonize military operations. |

| Emerging ESG Risks | AI accountability, cybersecurity, raw material supply | AI-driven targeting and surveillance; lack of international standards for autonomous defense systems; EU AI Act compliance; China’s export restrictions on critical materials. |

Source: Morningstar Sustainalytics. For informational purposes only.

Note: This does not represent a comprehensive list of ESG risks.

Emerging ESG Risks Related to Geopolitics, Artificial Intelligence, and Raw Materials

Geopolitical and technological developments in recent years have introduced new ESG risks across the defense sector.

The war in Ukraine has accelerated the adoption of AI-enabled and unmanned platforms, particularly drones. However, AI-driven targeting, surveillance, and autonomy raise serious accountability concerns, especially when machines influence critical decisions. Compliance risk related to AI has also increased. The EU AI Act, for instance, bans certain applications, sets strict rules on high-risk systems, and mandates auditable risk management and transparency protocols. Additionally, on the operational side, unmanned platforms expand the cyber and electronic-warfare attack surface, increasing pressure to adopt robust cybersecurity systems and architectures.

Meanwhile, China has introduced export restrictions on materials essential to defense sector production such as gallium, germanium, antimony, and graphite.8 This pressure adds to the impact of recent US tariffs, particularly on steel and aluminum. While many companies have built up inventories that help mitigate immediate risks — especially in Europe — ongoing disruptions, tariff volatility, and broader geopolitical uncertainty highlight the need to reduce reliance on traditional sources. Building resilience will require strategies such as greater use of recycled materials, end-of-life product stewardship, and raw material innovation.

Defense Sector Will Remain Under Scrutiny

Many listed defense companies appear to recognize the ESG risks they face and have established programs to manage them. Sustainalytics’ ESG Risk Ratings indicate that the sector has made progress in recent years.9 Between 2022 and 2024, more than 15% of defense sector companies within our universe moved from high and severe risk categories to medium risk. However, disclosure on certain topics, and in some markets, remains uneven.

For years, the sector remained largely excluded from mainstream investment strategies, limiting pressure to improve transparency on ESG-related issues. That has changed. Since 2022, more Article 8 and Article 9 labeled funds under the Sustainable Finance Disclosure Regulation have increased their defense exposure, and new defense-themed funds have launched, increasing investor scrutiny. Firms that can evidence robust ESG safeguards and measurable outcomes — alongside strong financial performance — may be better placed to attract capital.

Table 2. Summary of Companies Mentioned in this Article

| Entity Name | Country | Market Cap. (Billion USD) | Industry Group | Military Contracting - Involvement Revenue Range | ESG Risk Rating |

| RTX Corp. | United States of America | 212.29 | Aerospace & Defense | 50-100% | High |

| Lockheed Martin Corp. | United States of America | 106.37 | Aerospace & Defense | 50-100% | Medium |

| Rheinmetall AG | Germany | 85.35 | Aerospace & Defense | 50-100% | Medium |

| Thales SA | France | 54.08 | Aerospace & Defense | 50-100% | Medium |

| Northrop Grumman Corp. | United States of America | 84.48 | Aerospace & Defense | 50-100% | Medium |

| Siemens Energy AG | Germany | 84.30 | Electrical Equipment | 0-4.9% | Low |

| BAE Systems Plc | United Kingdom | 69.43 | Aerospace & Defense | 50-100% | Medium |

| Fincantieri SpA | Italy | 7.70 | Machinery | 25-49.9% | Low |

| Kitron ASA | Norway | 1.15 | Technology Hardware | 10-24.9% | Negligible |

| C.A.G Group AB | Sweden | 0.09 | Software & Services | 25-49.9% | Not Available |

For further analysis, read EU ESG Funds’ Exposure to Defense Continues to Increase.

For additional information on the Defense Readiness Omnibus, watch our webinar replay, Navigating EU ESG Rules and Defense Financing Priorities.

References

- Stockholm International Peace Research Institute (SIPRI). 2025. Unprecedented Rise in Global Military Expenditure as European and Middle East Spending Surges. April 28, 2025. https://www.sipri.org/media/press-release/2025/unprecedented-rise-global-military-expenditure-european-and-middle-east-spending-surges.

- European Commission. 2025. Defence Readiness Omnibus. https://defence-industry-space.ec.europa.eu/eu-defence-industry/defence-readiness-omnibus_en.

- European Commission. 2025. Commission Notice: On the Application of the Sustainable Finance Framework and the Corporate Sustainability Due Diligence Directive to the Defence Sector. https://defence-industry-space.ec.europa.eu/eu-defence-industry/defence-readiness-omnibus_en.

- European Commission. 2025. Communication from the Commission to the European Parliament and the Council. Defence Readiness Omnibus. June 17, 2025. https://defence-industry-space.ec.europa.eu/document/download/b2bcc9a0-5259-4543-9e1c-3af1dde8fbec_en?filename=Defence-Simplification-Omnibus.pdf.

- European Commission. 2025. Commission Notice: On the Application of the Sustainable Finance Framework and the Corporate Sustainability Due Diligence Directive to the Defence Sector. https://defence-industry-space.ec.europa.eu/document/download/ac79ebc7-d2f1-4e7a-a79c-71a06a5fdbf8_en?filename=notice-application-sustainable-finance-framework-and-corporate-sustainability.pdf.

- McKinsey & Company. 2024. "What are Scope 1, 2 and 3 Emissions?" September 17, 2024. https://www.mckinsey.com/featured-insights/mckinsey-explainers/what-are-scope-1-2-and-3-emissions.

- Scientists for Global Responsibility. 2022. Estimating the Military’s Global Greenhouse Gas Emissions. November 2022. https://ceobs.org/wp-content/uploads/2022/11/SGRCEOBS-Estimating_Global_MIlitary_GHG_Emissions_Nov22_rev.pdf.

- Tong, Zhang. 2025. “China’s ‘Silent Sanction’ on US Semiconductors Creates a Weapons Generation Gap.” South China Morning Post. September 5, 2025. https://www.scmp.com/news/china/science/article/3324489/chinas-silent-sanction-us-semiconductors-creates-weapons-generation-gap.

- For additional information watch our webinar titled Navigating EU ESG Rules and Defense Financing Priorities. https://www.brighttalk.com/webcast/19061/644910.