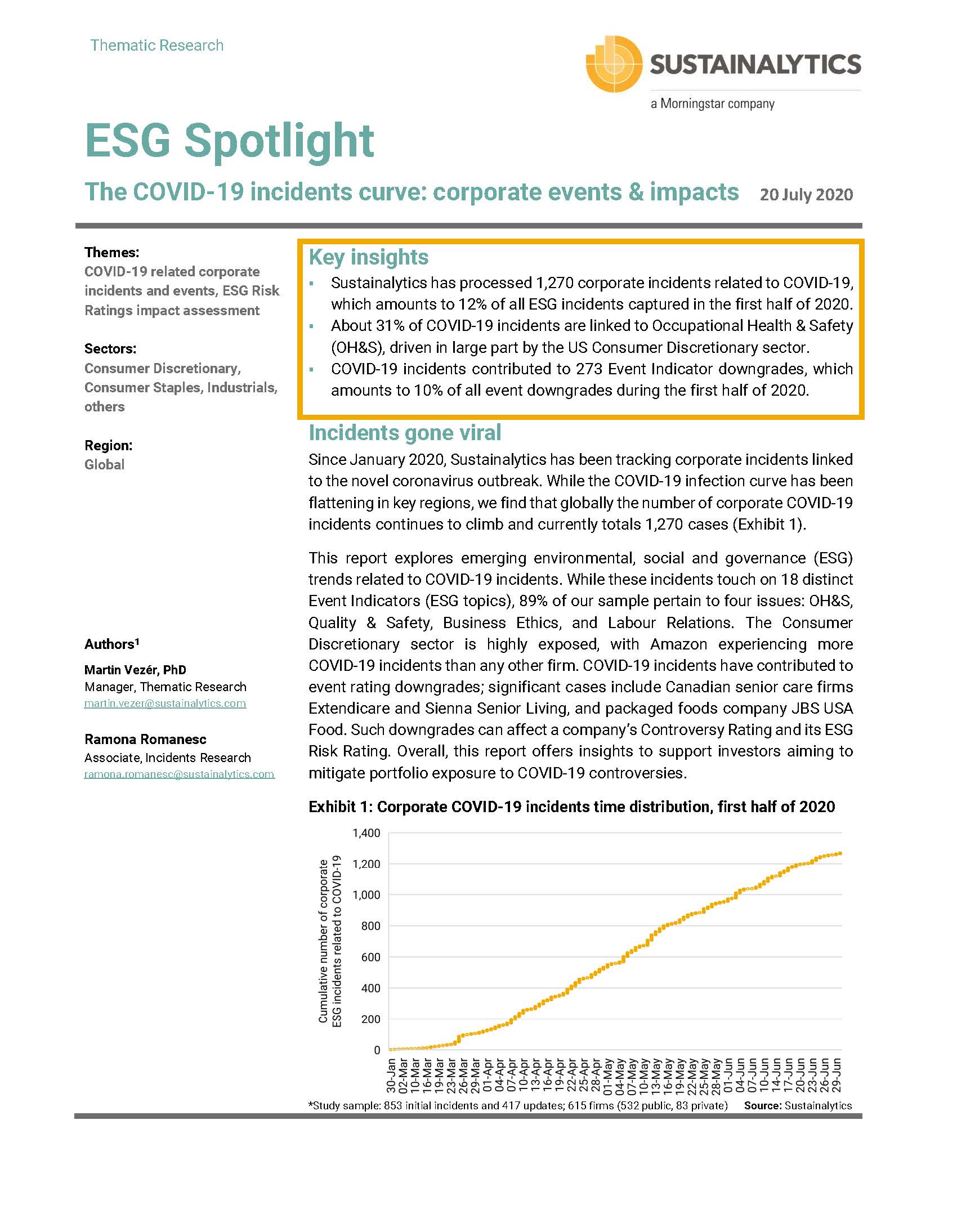

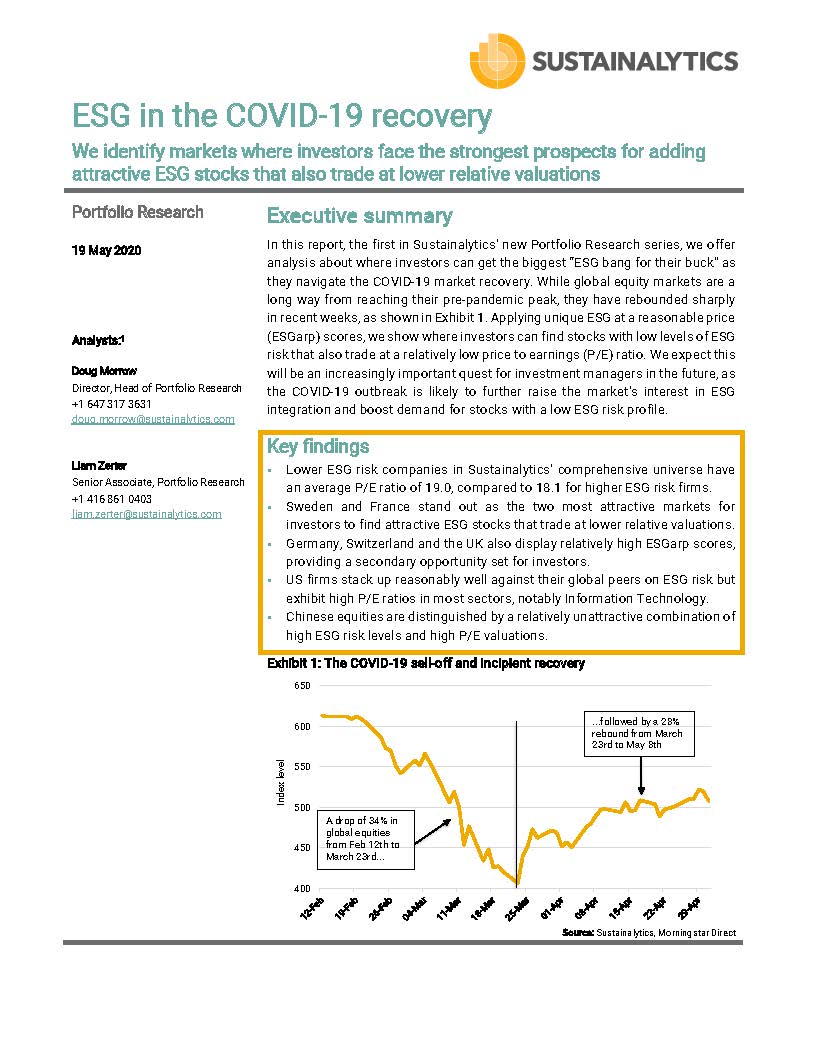

The current global pandemic has led institutional investors around the world to look closer at how ESG risks may impact companies within their portfolios. To aid investors’ thinking on the most material ESG issues facing industries and governments in the face of the pandemic, Sustainalytics’ dedicated Resource Center brings together our research-based insights focusing on the ESG implications of COVID-19. We hope you find it useful. Please contact us if you have any feedback or questions.

Responsible Investing: Risks and Opportunities

Key Themes Shaping Proxy Voting in 2022

As the volume and breadth of ESG risk exposure continue to rise, the stage is set for another momentous proxy season. The trending topics of last year will continue to steer the agenda—with the prospect of even more substantial support from shareholders in 2022.

3 Reasons to Skill Up and Scale Up ESG Stewardship in 2022

As our clients and the industry at large focus on proactively mitigating risk and capitalizing on this evolving landscape, stewardship will be a key lever for savvy investors—particularly those facing external pressure to divest. Here are the ESG themes we see influencing stewardship priorities this year.

Bringing Investors and Companies Together to Accelerate Human Rights Progress

Human rights issues have been rising on the responsible investment agenda in recent years. The COVID-19 pandemic and the Black Lives Matter movement have provoked even more pointed discourse on the topic. The European Union’s current efforts to introduce rules to hold companies accountable for social and environmental risks in their supply chains further accelerate that ascent. This wave of legal requirements and normative expectations is impacting financial markets worldwide, with responsible business regulations already in place or quickly becoming valid.

ESG Investors Consider Socioeconomic Impacts of COVID-19 in the Construction Industry

The construction industry can have a reputation for workforce insensitivity and is highly vulnerable to economic and social variabilities. The ESG Impacts of COVID-19 drive companies to adapt to significant challenges related to the demand for construction services. This construction sector research snapshot highlights relevant social issues that corporations face due to ripple effects from the pandemic using Sustainalytics’ ESG Risk Ratings and Controversies Research.

ESG Risk Exposure from COVID-19 Vaccine Transportation and Distribution

As mass vaccination against the coronavirus started, a key challenge has been to keep millions of doses of vaccines at the right temperature. An increase in temperature inside a truck or aircraft, by half a degree, for half an hour, would reportedly result in a 'defrosted' vaccine which has then to be discarded.

UNICEF Collaborates with Sustainalytics to Highlight Children’s Rights Issues for Investors

While child labor remains a serious problem across industries and countries, it is only one part of the overall issues pertaining to children’s rights; companies and investors should recognize the scope and relevance of this topic.

Is the COVID-19 Pandemic Threatening Progress on Gender Equity?

The COVID-19 pandemic has disrupted lives and livelihoods on an unprecedented scale. Despite massive government spending, the pandemic resulted in the global economy shrinking by 3.5% in 2020.[i] However, the financial burden of this pandemic has not been borne evenly.

Sustainable Finance: Risks & Opportunities

Sustainability-Linked Loans 2021: The COVID-19 Effect, ESG Ratings & Continued Popularity

The sustainable finance market has seen an exponential increase in size and activity in recent years. Innovative offerings such as green, social, and sustainable bonds, green and sustainability-linked loans (SLLs), and most recently sustainability-linked bonds, have contributed to the market’s incredible growth. In 2020, boosted by varied financial needs and mainstream recognition of environmental, social and governance (ESG) parameters, global sustainable debt capital surpassed US$700 billion, a 30% increase compared to 2019. Part of this capital was channelled towards tackling the effects of COVID-19 as government agencies, supranational bodies and corporates borrowed money to support areas most affected by the pandemic, such as healthcare. This shift in fund usage in 2020 resulted in the rapid growth of social bonds and a commendable first year for sustainability-linked bonds.

COVID-19 and Beyond: Using sustainable finance to build social resilience

As our global community continues to endure an altered way of life amidst the on-going COVID-19 outbreak, it is only natural to ask what each of our lives, professional and otherwise, will look like on the other side. Once children and teachers go back to school and workers return to their offices, will our society have done everything it could have to mitigate the social and economic impacts of this crisis and will we have built in resiliency against future system shocks?

Responding to COVID-19 through Social Bonds

In the space of four months since the first cases of COVID-19 were diagnosed in Wuhan, China, the virus has spread to 178 countries globally. As a consequence, nearly 3 billion people around the world are living with varying degrees of lockdown imposed by governments aiming to slow the spread of the contagion.

Environmental Issues

Key Themes Shaping Proxy Voting in 2022

As the volume and breadth of ESG risk exposure continue to rise, the stage is set for another momentous proxy season. The trending topics of last year will continue to steer the agenda—with the prospect of even more substantial support from shareholders in 2022.

3 Reasons to Skill Up and Scale Up ESG Stewardship in 2022

As our clients and the industry at large focus on proactively mitigating risk and capitalizing on this evolving landscape, stewardship will be a key lever for savvy investors—particularly those facing external pressure to divest. Here are the ESG themes we see influencing stewardship priorities this year.

Regulatory Standards and COVID-19: Is Oil and Gas Being Given a Hall Pass on ESG?

Globally, oil and gas companies are weathering a storm like no other in their history. Although volatility seems to have settled somewhat since the early months of 2020 (when the Russia-Saudi Arabia oil price war experienced its most heated moments yet), cost-cutting and debt borrowing continues to plague the industry as the vast majority of COVID-19 related restrictions remain in place worldwide.

Social Issues

Key Themes Shaping Proxy Voting in 2022

As the volume and breadth of ESG risk exposure continue to rise, the stage is set for another momentous proxy season. The trending topics of last year will continue to steer the agenda—with the prospect of even more substantial support from shareholders in 2022.

Bringing Investors and Companies Together to Accelerate Human Rights Progress

Human rights issues have been rising on the responsible investment agenda in recent years. The COVID-19 pandemic and the Black Lives Matter movement have provoked even more pointed discourse on the topic. The European Union’s current efforts to introduce rules to hold companies accountable for social and environmental risks in their supply chains further accelerate that ascent. This wave of legal requirements and normative expectations is impacting financial markets worldwide, with responsible business regulations already in place or quickly becoming valid.

ESG Investors Consider Socioeconomic Impacts of COVID-19 in the Construction Industry

The construction industry can have a reputation for workforce insensitivity and is highly vulnerable to economic and social variabilities. The ESG Impacts of COVID-19 drive companies to adapt to significant challenges related to the demand for construction services. This construction sector research snapshot highlights relevant social issues that corporations face due to ripple effects from the pandemic using Sustainalytics’ ESG Risk Ratings and Controversies Research.

Country Risk

ESG at a Reasonable Price in China

Over the last decade, portfolio managers worldwide have been increasingly convinced that incorporating environmental, social, and governance (ESG) criteria into investment decisions could provide better risk-adjusted returns. As a result, responsible investing, has moved from a niche activity to the mainstream. As more capital shifts to ESG products, there have been discussions regarding the risk of an ESG bubble as stocks with good ESG scores have enjoyed price appreciation and sometimes go beyond fundamentals[i].