#InvestInOurPlanet

Earth Week is an opportunity to reflect on environmental strategies and the changes needed to ensure a sustainable future.

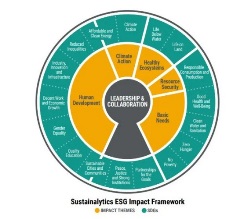

Investors and companies around the world are partnering with Sustainalytics to drive change that can have positive ESG impacts on their investment strategy and align with their values—while striving to make change for good.

Leading up to Earth Day on April 22, Sustainalytics’ global network of analysts and thought leaders share their insights through recent reports, videos, articles, research snapshots and more.

Taking on meaningful action for Earth Day involves diverse perspectives, adaptability, and collaboration. Learn more about how investors and companies are leveraging ESG considerations for their objectives.

Investor Insights

The Emergence of Water Risk: From Marginal to Systemic

The past two decades have seen a surge in interest in environmental issues, mainly climate change, global warming, and fossil fuels. Yet, another equally important dimension - water scarcity - has thus far remained largely unexamined and has not been given adequate importance in the economic development agendas of many countries.

Mass Timber in Construction - Big Buildings, Smaller Carbon Footprint

As an innovation in the industry, mass timber construction emits significantly less carbon than traditional concrete and metal structures, while modular construction ensures usability across many building types. This article reviews some of the concerns over structural strength, fire safety, regulatory compatibility, cost savings and the sustainability of increased forestry. It then examines current mass timber buildings and projects and looks at their viability as an alternative material for the future.

3 Reasons to Skill Up and Scale Up ESG Stewardship in 2022

As our clients and the industry at large focus on proactively mitigating risk and capitalizing on this evolving landscape, stewardship will be a key lever for savvy investors—particularly those facing external pressure to divest. Here are the ESG themes we see influencing stewardship priorities this year.

EU Taxonomy in Limbo - Reporting Alignment of Article 8 and 9 Funds in 2022

For observers of the EU’s Sustainable Finance Strategy, 2022 kicked off with a crack and a bang as the European Commission went ahead with plans to include natural gas and nuclear-related activities as potentially sustainable under their ‘Green Taxonomy’. However, in midst of this furor, seemingly less attention has been paid to other components of the regulation that have quietly taken effect from the 1st of January 2022, presenting their own set of challenges.

The ESG Risks of National Oil Companies Taking Over Fossil Fuel Production from International Oil Majors

As growing pressure to cut GHG emissions is causing Western oil majors to sell their high-carbon assets, it is expected that National Oil Companies (NOCs) will pick up some of the production. For investors holding an interest in or considering investing in NOCs or sovereign debt, it is worth assessing how fossil fuel production shifts will impact their portfolio’s alignment with climate ambitions and ESG values.

COP 26: A Spotlight on Emerging Climate Action Themes for Investors

Reactions to the COP26 Conference and the resulting Glasgow Climate Pact have predictably run the gamut from claims of greenwashing to the celebration of progress in the fight against climate change. Ultimately, any judgement on COP26 may be premature, as the success of the conference will best be measured in time by the extent to which commitments made are put into motion. While we wait to see the concrete actions that materialize, the past two weeks have underscored the importance of several themes that will garner increasing attention and should be considered by sustainable investors.

Biodiversity: A Crisis Equaling, Possibly Exceeding, Climate Change

According to the UN’s Convention on Biological Diversity the main drivers of biodiversity loss are habitat loss and degradation, climate change, pollution, over-exploitation, and invasive species. Habitat loss is directly linked to the conversion of natural ecosystems to agricultural lands and unsustainable use of water resources.

Events

Morningstar Investment Conference 2022

Chicago | Virtual | May 16 - 18, 2022 | View the Agenda

ESG Spotlight: Featured Speakers from Sustainalytics

.png?sfvrsn=8ae97d00_1)

Corporate Sustainability

Q&A | Financing the Future: An Interview on How Banks are Embarking on Their ESG Journeys

Financing the Future: Conversations in Sustainable Finance is a Q&A series where we sit down with featured ESG experts from Sustainalytics, sharing their insights on how businesses are using finance to meet the challenges of our transition to a sustainable future.

Second Party Opinion - Green, Social and Sustainability Bonds

Issuers looking to support their sustainability strategy through sustainable finance solutions have several options, from sources of debt to equity instruments. These solutions include Green Loans, Sustainability Linked Loans, Green Bonds, Sustainable Bonds and more.

ESG Risk Ratings and Material ESG Issues

Water-Related Risks and Challenges

This report sheds light on the growing effects of water scarcity on companies and countries. To address these challenges, investors can use water reporting metrics to identify companies and countries with severe water risk. We further relate water metrics to firm and country characteristics and highlight substantial cross-sectional differences.

Material ESG Issues: Carbon Own Operations

An accelerated global agenda is in place to transition to a low carbon economy. How companies minimize the long-term risks associated with traditional business models while transitioning to a low carbon future is key to understanding and managing carbon risk.

ESG Stewardship

Discover how environmental risks can be managed systemically in your ESG stewardship strategy with Engagement 360.

What Happens When Companies are Receptive to Investor Feedback on ESG?

When companies are receptive to investor feedback, there are clear real-world impacts and positive changes. Such engagement outcomes vary and are directly tied to the company and its company-specific exposure to material ESG issues.

North American Material Risk Engagement Trends: ESG Reporting Frameworks, Emission Reduction Targets and Beyond

There are many factors that rating agencies consider within its overall assessment. For example, ESG rating companies tend to look for at least three years of ESG metrics to determine company trends and long-term ESG targets, goals, and strategies to manage and reduce ESG risks at least five years ahead. Read on to learn about how Sustainalytics' Material Risk Engagement program promotes and protects long-term value by engaging with high-risk companies on financially-material ESG issues. (A North American Snapshot)

Green Business

Measuring What Matters: Initiatives for Banks' Climate-Related Impact and Disclosure

To help financial institutions examining the climate impact of their portfolios, we’ve compiled a list of the initiatives and organizations offering guidance on the collection, measurement, and disclosure of climate-related financial data.

Related Products

ESG Risk Ratings

Take a coherent and consistent approach to assessing financially material ESG risks.

Learn More

Impact Solutions

Manage and report on the social and environmental impact of your portfolio

Learn More

Material Risk Engagement

A proactive engagement with companies with the greatest unmanaged financially-material ESG risks.

Learn MoreMorningstar Sustainability Insights for Advisors and Wealth Managers

Connect with us to discover Sustainalytics' ESG Solutions

Investor Opportunities

Our core research and ratings solutions have enabled the world’s leading institutional investors to identify, understand, and manage ESG-driven risks and opportunities. As a part of Morningstar, we continue to accelerate our efforts to bring meaningful ESG insights to investors of all types across different asset classes at the company and fund level.

Corporate Opportunities

Sustainalytics’ Corporate Solutions unit works with hundreds of companies and their financial intermediaries to help them consider sustainability in policies, practices, and capital projects.