ESG Spotlight | Supply Chain Incidents: Understanding the Impacts

To help investors understand supply chain controversies, this report explores how supply chain incidents are distributed over time and across industries, markets and event categories. Our analysis aims to enable investors to identify potential areas of portfolio exposure as well as topics for corporate stewardship activities.

ESG Spotlight Report - Investing in racial diversity: North American equities

Access Sustainalytics' second ESG Spotlight Series report on race and ethnic diversity this year. Building on insights from the previous ESG Spotlight, the next series installment focuses on bridging the demographic data gap by compiling corporate disclosures of employee composition. Our research shows that companies with more diverse upper management tended to deliver greater financial returns than those with less diverse upper management over the last five years.

ESG Spotlight Report - Race, Ethnicity and Public Equity: A Global Snapshot

Sustainalytics has published a new ESG Spotlight Series report, Race, Ethnicity and Public Equity: A Global Snapshot, which presents an analysis of racial and ethnic issues linked to listed companies’ operations, supply chains and the societal impacts of their business activities. Our research finds that although a growing number of firms are disclosing diversity and anti-discrimination initiatives, management gaps persist and related controversies are on the rise.

ESG Risk Ratings Methodology

The ESG Risk Ratings measure the degree to which a company’s economic value is at risk driven by ESG factors or, more technically speaking, the magnitude of a company’s unmanaged ESG risks. A company’s ESG Risk Rating is comprised of a quantitative score and a risk category.

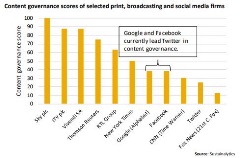

Managing data privacy risk: comparing the FAANG+ stocks

Collecting and processing personal data has become one of the most significant drivers of financial value in today’s economy. But as the upside of personal data grows, so too does the downside risk associated with data security, management and privacy.

Beware of Bears: A Look Back at the Downswing of 2018

Overlaying Sustainalytics’ ESG Risk Ratings onto the FTSE AW Index, we found that 24 percent of the benchmark’s market cap was rated as having high to severe levels of ESG risk. In addition, over the course of Q4 2018 the negligible to low ESG risk companies outperformed the benchmark by 55 basis points. Our sample portfolio containing 300 best-in-class ESG performers would have returned 77 basis points more than the benchmark in Q4.

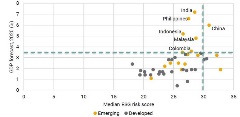

Emerging Markets Equities: Key Sources of ESG Risk

Based on our analysis, we find that investors in the FTSE Emerging Index are exposed to over 14 percent more unmanaged ESG risk than those in the FTSE Developed Index. The ESG risk gap between these indices is largest on the issue of data privacy and security. In addition, investors in select equity markets, such as China, may face a trade-off between chasing higher economic growth and mitigating portfolio ESG risk.

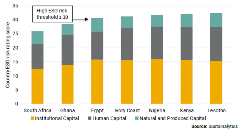

New Frontiers: African Sovereign Debt and ESG Risk

In New Frontiers: African Sovereign Debt and ESG Risk, we leverage our Country Risk Ratings to analyze ESG risk among African countries. Our findings show country-level ESG risk and average sovereign credit ratings exhibit a strong positive correlation.

The Budding Cannabis Industry: A first look at ESG Considerations

While investors are being drawn to the cannabis industry by the lure of an expanding market and profit potential, uncertainties around regulations, scalability and potential stock price corrections remain. Underexplored ESG risks could also present material concerns for management teams and investors entering the industry.

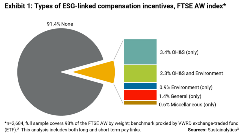

The State of Pay: Executive Remuneration & ESG Metrics

With investors increasingly incorporating ESG considerations into their investment decisions, many are looking into how corporate leadership may be incentivized to pursue an ESG agenda. This report offers insights to global equity investors considering pay-links as a topic for corporate engagement.

ESG Spotlight | Assault Weapons: assessing exposure to the firearms trade

The Parkland shooting prompted a swift reaction from many influential corporations and investors. A growing list of corporates, including Delta Air Lines, Enterprise, Symantec and First National Bank of Omaha, have cut ties with the National Rifle Association.

ESG Spotlight | The rise of gender equity: momentum building in key markets

A recent wave of popular movements has drawn unprecedented attention to the longstanding issue of gender equity. In cities around the world, women have marched to demand political and economic equality, while the #MeToo movement has amplified calls for an end to discrimination and harassment.

.tmb-small.png?Culture=en&sfvrsn=242fe90f_1)