ESG Risk Premium: A Further Look at Style, Industry and Country Factors

In Volume 3 of the Quantitative Investment Approaches for ESG Risk series created in partnership with Natixis, this report uses a novel portfolio construction to examine style, industry and country factors and their respective contributions to active ESG risk in the United States, Canada, Europe, and Asia-Pacific.

ESG Risk Ratings: Distilling for Enhanced Performance and Downside Protection

In Volume 2 of the Quantitative Investment Approaches for ESG Risk series created in partnership with Natixis, this report examines the impact of ESG risk on portfolio performance, volatility, downside risk and financial health.

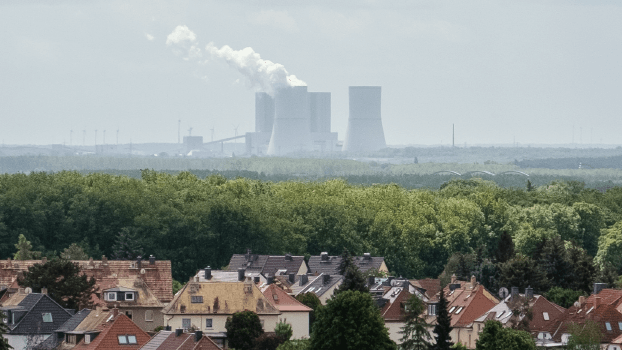

Reducing Emissions Through Sustainable Finance: A Guide for Companies in Carbon Intensive Industries

This corporate guide discusses the difficulties in measuring, reporting, and reducing GHG emissions in hard-to-abate sectors and provides key takeaways so that companies can take advantage of the opportunities sustainable finance offers.

Managing Risks for a Changing Climate: A Guide for Institutional Investors

Gain a better understanding of physical and transition climate risks and their potential impacts to effectively respond to climate risks in investment portfolios and comply with the growing list of climate-focused reporting frameworks and regulations.

Meeting Investor Expectations Through Corporate ESG Reporting, Planning and AGMs

Investors are increasingly influenced by ESG ratings and companies’ approaches to managing ESG risk. While an annual general meeting (AGM) is an ideal opportunity to communicate company plans around managing these risks, ESG reporting goes beyond an AGM or proxy season. Investors want investing to align with values, but are also looking at risk exposure and management.

Why Impact Matters: Seven Essential Considerations for Investors

Today’s investors are facing increased scrutiny from stakeholders for greenwashing risk. ESG-related disclosure regulations are quickly advancing and more customers are seeking impact-focused products. This market environment demands heightened transparency and credibility, and investors need to know how Impact can help them rise to these challenges and meet their diverse sustainability goals.

An Introduction to the Circular Economy: A Beginner’s Overview on Transforming Production to Minimize Waste

This ebook looks at the circular economy through an ESG lens, exploring why it is gaining traction with governments and businesses, emerging challenges during this transition, and what potential solutions look like.

Asia-Pacific Supplement to the Morningstar Sustainalytics Corporate ESG Survey Report 2022

In this Asia-Pacific supplement to the Morningstar Sustainalytics Corporate ESG Survey Report 2022, we share additional findings showing how CSR and sustainability teams in the APAC region are managing ESG programs and compare their responses to the world.

Europe, Middle East, and Africa Supplement to the Morningstar Sustainalytics Corporate ESG Survey Report 2022

In this Europe, Middle East, and Africa supplement to the Morningstar Sustainalytics Corporate ESG Survey Report 2022, we share additional findings showing how CSR and sustainability teams in the EMEA region are managing ESG programs and compare their responses to the world.

Americas Supplement to the Morningstar Sustainalytics Corporate ESG Survey Report 2022

In this Americas supplement to the Morningstar Sustainalytics Corporate ESG Survey Report 2022, we share additional findings showing how CSR and sustainability teams in the Americas are managing ESG programs and compare their responses to the world.

The EU Action Plan on Financing Sustainable Growth: Twelve Essential Questions Answered for Investors

Learn what the EU Action Plan is, its objectives, and the importance of taking immediate action to comply with its various regulations including the EU Taxonomy Regulation, Sustainable Finance Disclosure Regulation, and the EU Benchmarks Regulation.

The Morningstar Sustainalytics Corporate ESG Survey Report 2022: CSR and Sustainability in Transition

CSR and sustainability teams are taking on greater responsibility for ESG activities. As a result, corporate sustainability professionals need to understand how ESG is evolving, how peers are facing ESG risks, and how to approach ESG reporting and ratings.