Reducing Emissions Through Sustainable Finance: A Guide for Companies in Carbon Intensive Industries

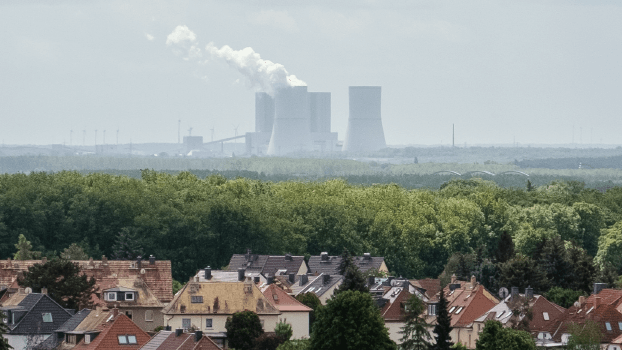

This corporate guide discusses the difficulties in measuring, reporting, and reducing GHG emissions in hard-to-abate sectors and provides key takeaways so that companies can take advantage of the opportunities sustainable finance offers.

Risk and Opportunity in Biodiversity: How Sustainable Finance Can Help

This article outlines how biodiversity loss poses material risks to business and how it connects to many other issues that companies can’t ignore. In addition, it covers how biodiversity conservation presents substantial economic opportunities, and how businesses can address and access these opportunities by issuing linked instruments that integrate biodiversity considerations.

What’s Happening in Sustainable Finance: Green Bond Standards on the Horizon and Much More

In this month’s round up of sustainable finance deals and developments, we look at what the EU Green Bond Standard could mean for the market, innovations in use of proceeds, and the ongoing diversification of industries tapping the market.

What’s Happening in Sustainable Finance: GSSS Market Rebounds, Sovereign Sustainable Debt, and Much More

Get caught up on developments in the global sustainable finance market. This month, we discuss market performance for the first part of the year, continuing scrutiny of SLBs, and the growing group of sovereigns exploring sustainable debt opportunities.

What’s Happening in Sustainable Finance: A Flurry of Updates in Regulations, Taxonomies, Frameworks, and Much More

Discussing the flurry of updates in sustainable finance regulation and guidance such as progress on the EU GBS; updates to the various sustainable loan principles; and the release of fourth and final beta version of the TFND framework.

What’s Happening in Sustainable Finance: Innovative Finance Instruments Breaking Ground, Use of Proceed Bonds Back in Vogue, and More

Could innovation help the sustainable finance market rebound in 2023? Will scrutiny of linked instruments continue to push investors back to use of proceed transactions? We tackle these topics and more in our latest episode.

What’s Happening in Sustainable Finance: On the Horizon for 2023, Reporting on Financed Emissions for Sovereign Debt, and More

Despite ending 2022 on a low note, there is optimism for the global sustainable finance market in 2023 as sustainability is still a key issue for investors, issuers and governments and remains closely tied to capital markets.

What’s Happening in Sustainable Finance: Climate on the International Agenda, New Instruments to Support Emerging Markets, and More

Climate change and adaptation are high on the international agenda. Listen to learn how the outcomes from COP27 and COP15 could influence sustainable finance markets and get a rundown of recent notable market transactions.

What’s Happening in Sustainable Finance: Funding Emerging Markets’ Climate Adaption, Regulatory Focus on Scope 3 Emissions, and More

As 2022 winds down, we discuss notable developments in sustainable finance, including global green bond issuance surpassing $2 trillion, growing regulatory focus on scope 3 emissions reporting, and opportunities to support climate adaptation, and just transition in emerging market via sustainable finance activities.

Infographic | What's Driving Corporate ESG? CSR and Sustainability Professionals Have Their Say

Discover what CSR and sustainability professionals say are the top motivations and influences driving their firms’ corporate ESG programs in our infographic, featuring data from the Morningstar Sustainalytics Corporate ESG Survey Report 2022: CSR and Sustainability in Transition.

Sustainable Finance Insights: Special Episode on Sustainable Finance in the Metals, Mining and Commodities Sector

In this special episode, we focus on sustainable and transition finance opportunities for issuers in the metals and mining sector and discuss considerations for banks, issuers and investors to fund improvements and mitigate environmental, social and regulatory risks.