Using Systems Thinking to Avoid ESG Investing Blind Spots

For investors looking to enhance ESG risk management and the long-term impact of sustainability efforts, a systemic approach can help identify interventions that will most effectively mitigate the risk of negative outcomes or divert the chain of events towards a more sustainable trajectory. Typically, this involves moving from single-issue or company-specific tactics to progressively integrate system-level considerations in ESG strategies. Targeting systemic change through active ownership is one way to acknowledge and start unravelling the dynamic web of global challenges.

Sustainalytics Weighs in on EU Taxonomy’s State of Flux

On May 7th, the European Commission published draft rules on how corporates and financial institutions should report on their alignment with the EU Taxonomy. The draft rules are laid out in a very technical document and not an easy read. This might explain why certain changes with significant impact on timelines and scope of the EU Taxonomy Regulation have flown under the radar of media and investors. Some of the impacts even escaped the attention of financial market participants responding to the consultation on the rules.

Banks Embrace Corporate Culture as Change Agent

Corporate culture is not automatically positive, and elements of a company’s culture may provide certain benefits or disadvantages to a firm’s competitiveness. When acknowledged, corporate culture can be used as a tool to drive better business outcomes and manage conduct and compliance risk. Our discussions with companies show that corporate culture can have a dominant effect and influence behaviour over and beyond stated company policies and programs.

UNICEF Collaborates with Sustainalytics to Highlight Children’s Rights Issues for Investors

While child labor remains a serious problem across industries and countries, it is only one part of the overall issues pertaining to children’s rights; companies and investors should recognize the scope and relevance of this topic.

Personal Products and the New Ethics of Product Naming

Over recent years, personal product (PP) companies have faced an increasing demand for more inclusive product governance – from formulations to labels – and marketing that reflects the diversity of consumers. To grow sustainably within their communities and stay relevant for their target customers, such companies need to create value for society proactively. Some of the major players in this industry have already started paving the way for others.

EU Sustainable Finance Disclosure Regulation: An Update

Update - 3 March, 2021: To help investors comply with the new requirements of the SFDR, Sustainalytics launched the PAI Data Solution that maps our research to the 60 indicators defined by the regulator. This new dataset will enable investors to consider the PAIs in their investment decisions as well as supporting disclosure requirements. Visit our website to learn how we can help with you SFDR compliance journey.

Lessons Learned from 926 Engagement Meetings in Emerging Markets

When Sustainalytics (GES[1]) initiated the Emerging Markets (EM) Engagement program as a pilot project in 2009, the scale, scope and impact were undetermined factors. Based on the successful execution of the program methodology in the African and Middle Eastern regions during the pilot stage, the full program launched in 2010 to cover all major emerging markets. After the project close in July 2020, the program accounts for 926 meetings with companies in emerging markets.

Integrating Climate Risk into Corporate Governance

Since the introduction of the Taskforce on Climate-related Financial Disclosures (TCFD), there has been increased scrutiny of corporate climate governance and broader associated risks. Investors have increased their focus on climate risk, as governance mechanisms are likely to be impacted by transition and physical risk challenges[i].

If the proxy vote is your voice, what are you saying?

To date, 2020 has marked record inflows to sustainable investments[1]. Elevated globally by a health, social and financial crisis; investors and stakeholders alike are coming to understand the inherent risk of ignoring key environmental, social and governance factors. Current events coupled with new regulations and stakeholder pressure are creating the need for investors to demonstrate their commitment as responsible owners who view corporate accountability as a means to achieving greater long-term value.

Tomorrow’s Board: Challenges in a Fast-Changing World

The world is changing faster than it ever has. As a result, companies are increasingly facing numerous and complex challenges with both immediate and long-term impacts. Today, companies are facing a health crisis, a social justice crisis and a fallout economic crisis. The ongoing COVID-19 pandemic and the social justice crisis, calling for the end of systemic racism, have reinforced the need for more diverse boards.

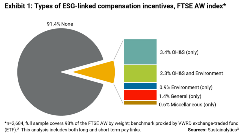

The State of Pay: Executive Remuneration & ESG Metrics

With investors increasingly incorporating ESG considerations into their investment decisions, many are looking into how corporate leadership may be incentivized to pursue an ESG agenda. This report offers insights to global equity investors considering pay-links as a topic for corporate engagement.

Tomorrow's Board

The world is changing faster than it ever has. As a result, companies are facing increasingly complex and numerous challenges. They need to adapt faster, and in this process, the board has a crucial role to play. A new vision of the board is needed to help start a process today that will result in them being better prepared for tomorrow’s challenges.

Governance of SDGs

This thematic engagement is aimed at encouraging companies to define meaningful SDG strategies that align with their business plans. It aims to influence them to address their negative impacts and seek out opportunities to produce positive outcomes in line with the 2030 SDG agenda, while contributing to a more stable long-term operating environment for themselves.

India Raises Corporate Governance Standards

India saw several enhancements to its corporate governance framework on April 1, 2019, when the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) (Amendment) Regulations, 2018 came into effect. The amendments to SEBI listing regulations reflect the adoption of a slew of recommendations made by the “Kotak Committee” – a blue-ribbon panel formed in June 2017 under the chairmanship of banker Uday Kotak, with the purpose of improving corporate governance standards in India. The committee’s recommendations are being phased in between October 1, 2018 and April 1, 2020.

Redefining the purpose of a corporation – theory or practice?

In August 2019, the U.S. Business Roundtable (BRT), a non-profit association composed of corporate CEOs, issued a statement redefining the purpose of a corporation. The BRT has defined a corporation’s purpose as working for the benefit of all stakeholders, such as customers, employees, suppliers, communities where the company operates, as well as shareholders. Drafted following months of consultation with CEOs and members of the political, academic and NGO sectors, the statement was signed by 181 CEOs, or 95% of BRT members (though not by the companies they represent).

The 2018 UK Corporate Governance Code – A refreshed view on corporate governance

On July 16th, the Financial Reporting Council released the revised UK Corporate Governance Code,[1] which will take effect on 1 January 2019. The new Code focuses on the relationship between companies, their shareholders, stakeholders and corporate culture. It is shorter and sharper and sets higher standards of corporate governance.

Blockchain-enabled proxy voting on the horizon

While blockchain technology is popularly associated with cryptocurrencies such as Bitcoin, its inherent use case lies in its capacity to maintain registries that are at once speedy, secure, transparent, coherent and reliable. As a result, new solutions have either been proposed, or are being developed, for such disparate areas as land registries, insurance, financial products, healthcare records, and smart appliances. Many of these fields are currently overseen by government bureaucracies or other third-parties, with comparatively sluggish manual input occurring for such mundane tasks as data entry, data retrieval, and user verification. Theoretically, blockchain-enabled “smart contracts” would allow these clerical tasks to be accomplished in a fraction of the time.

<UPDATE> P&G vs Trian Partners - the Largest Proxy Fight in History

Preliminary results show that Nelson Peltz lost his proxy contest against P&G. At the conclusion of the AGM, the company announced the election to the board of all 11 of its nominees. Peltz is not yet admitting defeat, stating that the vote results are” too close to call” (within a 1% margin), and has called for P&G to appoint him on the board regardless the vote count. Following the news, P&G’s stock price dropped by 2.7% to USD 89.86, closing, however, at USD 91.62.

.tmb-thumbnl_rc.png?Culture=en&sfvrsn=72dd1885_2)