Enhancing Risk-Return Profile by Combining ESG Risk and Economic Moats

Hear from Sustainalytics' Methodology and Portfolio Research specialist, Liam Zerter, as he talks us through the key findings from Sustainalytics' recent Combining ESG Risk and Economic Moat report, which shows that economic moat and ESG risk can be combined to create investment strategies that generate value both in terms of returns and portfolio risks.

Five Commonly Asked Questions About Sustainalytics’ Approach to Impact

We launched our new Impact Metrics product to support investors’ growing need for more robust data that can be used to demonstrate how ESG-focused strategies can deliver real-world social and environmental outcomes. Since the launch, I have connected with many enthusiastic institutional investors eager to make sense of the rapidly evolving world of impact, excited to dive into impact data, and cautiously optimistic about supporting their clients’ Sustainable Development Goal (SDG) and impact needs.

EU Sustainable Finance Disclosure Regulation: An Update

Update - 3 March, 2021: To help investors comply with the new requirements of the SFDR, Sustainalytics launched the PAI Data Solution that maps our research to the 60 indicators defined by the regulator. This new dataset will enable investors to consider the PAIs in their investment decisions as well as supporting disclosure requirements. Visit our website to learn how we can help with you SFDR compliance journey.

10 for 2021: Investing in the Circular Economy

This report aims to support investors interested in gauging environmental, social and governance (ESG) risks and opportunities in the global food value chain. We survey key subindustries – from agrochemicals, agriculture and aquaculture to packaged food, food retail and restaurants – in search of solutions that may support the principles of the circular economy (CE). These principles include minimizing waste and pollution, extending the use-phase of products and ecosystem regeneration. Some of the key insights found in the report are:

Lessons Learned from 926 Engagement Meetings in Emerging Markets

When Sustainalytics (GES[1]) initiated the Emerging Markets (EM) Engagement program as a pilot project in 2009, the scale, scope and impact were undetermined factors. Based on the successful execution of the program methodology in the African and Middle Eastern regions during the pilot stage, the full program launched in 2010 to cover all major emerging markets. After the project close in July 2020, the program accounts for 926 meetings with companies in emerging markets.

Combining ESG Risk and Economic Moat

In this report, we look at the potential synergies between Sustainalytics’ ESG Risk Ratings and Morningstar’s Economic Moat Rating. As a part of our research, we constructed a back-testable investment strategy and portfolio by segmenting stocks with low ESG risk and a wide moat. While both metrics worked independently, they performed exceptionally well in combination.

ESG Risk Ratings Methodology

The ESG Risk Ratings measure the degree to which a company’s economic value is at risk driven by ESG factors or, more technically speaking, the magnitude of a company’s unmanaged ESG risks. A company’s ESG Risk Rating is comprised of a quantitative score and a risk category.

Sustainable Finance Disclosure Regulation: An Industry Game-changer

In recent months, the Sustainable Finance Disclosure Regulation (SFDR) has been sparking almost as much debate as the EU Taxonomy – both cornerstone regulations of the EU Sustainable Finance Action Plan. With the SFDR set to redefine ESG disclosures and make a significant impact on financial market participants in Europe, the short timeline and ambiguity on several vital details are creating confusion and concern in the industry. The risk of organizations not being able to comply in time is still present, despite the announced delay in timelines for the technical standards, as is the risk of high financial and operational costs for the industry.

A Pipeline for Strategic ESG Risk Mitigation

Given the ESG impacts often associated pipeline projects, it is reasonable to say that pipelines have been a source of controversy in North America and around the world. In 2020 alone, several major pipeline projects face high levels of public and community-based opposition; with consequences including widespread protests (as was the case for TC Energy’s Coastal GasLink project at the beginning of this year) and large-scale regulatory and legal challenges (as seen currently with the Dakota Access Pipeline).

ESG Innovators in the ever-changing world of investment solutions

NN Investment Partners (NN IP) is the asset manager of NN Group N.V., a publicly traded corporation, headquartered in The Hague, the Netherlands. NN Investment Partners offers specialized SRI funds and tailor-made responsible investment solutions that meet the growing demand for products that generate good financial returns and at the same time have positive impact on society.

ESG at a Reasonable Price in China

Over the last decade, portfolio managers worldwide have been increasingly convinced that incorporating environmental, social, and governance (ESG) criteria into investment decisions could provide better risk-adjusted returns. As a result, responsible investing, has moved from a niche activity to the mainstream. As more capital shifts to ESG products, there have been discussions regarding the risk of an ESG bubble as stocks with good ESG scores have enjoyed price appreciation and sometimes go beyond fundamentals[i].

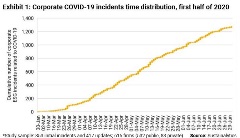

Understanding ESG Incidents: Key Lessons for Investors

Our Thematic research report, Understanding ESG Incidents: Key Lessons for Investors, provides a complete exploration of Sustainalytics’ incidents collection framework and offers comprehensive insight into company activities that generate undesirable social or environmental effects.

Sustainable Fund Labels: Diverse Definitions of Sustainability

Sustainable financial products are marked with an increasingly large list of tags, from green, sustainable, socially responsible to thematic ESG, water, carbon or impact funds, and not every investor might know how to make sense of these terms. Sustainable fund labels can be one way to signal to the market that the fund has a dedicated responsible investment strategy.

How Investors Integrate ESG: A Typology of Approaches

This report, How Investors are Integrating ESG: A Typology of Approaches, classifies ESG integration approaches along three dimensions: management (who is integrating ESG), research (what is being integrated), and application (how the integration is taking place). The authors then used the typology to identify six prevailing approaches of ESG integration in the market today.

ESGarp Scores: In Search of Reasonably Priced, Low ESG Risk Stocks

The COVID-19 pandemic is likely to further amp up the market’s interest in ESG investment research. It’s not just that ESG funds and indices have generally outperformed their non-ESG counterparts since the COVID-19 sell-off began in mid-February.[i] It’s also that the pandemic itself has drawn attention to ESG issues ranging from biodiversity and habitat loss to employee relations and supply chain management.

.tmb-thumbnl_rc.png?Culture=en&sfvrsn=881ecd4b_2)

.tmb-small.jpg?Culture=en&sfvrsn=98d0d2f9_2)

.tmb-small.png?Culture=en&sfvrsn=fd535425_2)