Corporate ESG Ratings: How businesses are leveraging their ESG Risk Ratings

Good environmental, social and governance (ESG) performance is not just about meeting investor demands. From revenue generation and raising capital to talent acquisition and employee retention, strong corporate ESG performance can influence key aspects of a company’s operations.

ESG Innovators in the ever-changing world of investment solutions

NN Investment Partners (NN IP) is the asset manager of NN Group N.V., a publicly traded corporation, headquartered in The Hague, the Netherlands. NN Investment Partners offers specialized SRI funds and tailor-made responsible investment solutions that meet the growing demand for products that generate good financial returns and at the same time have positive impact on society.

Understanding ESG Incidents: Key Lessons for Investors

Our Thematic research report, Understanding ESG Incidents: Key Lessons for Investors, provides a complete exploration of Sustainalytics’ incidents collection framework and offers comprehensive insight into company activities that generate undesirable social or environmental effects.

What are Sustainability Linked Loans (SLLs)?

A Sustainability Linked Loan is focused on incentivizing sustainability improvements among corporate borrowers by linking the terms of the loan to their overall sustainability performance targets. SLLs can be used for general corporate purposes as the terms are tied solely to the borrower’s ESG-related performance.

How Investors Integrate ESG: A Typology of Approaches

This report, How Investors are Integrating ESG: A Typology of Approaches, classifies ESG integration approaches along three dimensions: management (who is integrating ESG), research (what is being integrated), and application (how the integration is taking place). The authors then used the typology to identify six prevailing approaches of ESG integration in the market today.

Pre-engagement study on labour rights in food supply chains

Labour rights issues in food supply chains are crucial matters to investors, both in terms of compliance with international human rights norms and national legislation, and from the material point of view of securing future supplies. With this background, GES, in collaboration with AP7, The Seventh Swedish National Pension Fund, conducted a pre-study to provide input for the development of a new engagement initiative.

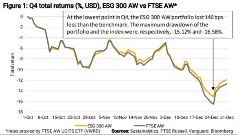

Beware of Bears: A Look Back at the Downswing of 2018

Overlaying Sustainalytics’ ESG Risk Ratings onto the FTSE AW Index, we found that 24 percent of the benchmark’s market cap was rated as having high to severe levels of ESG risk. In addition, over the course of Q4 2018 the negligible to low ESG risk companies outperformed the benchmark by 55 basis points. Our sample portfolio containing 300 best-in-class ESG performers would have returned 77 basis points more than the benchmark in Q4.

Water Stewardship Engagement

The Water Stewardship and Risk Engagement combines both scale and detail, and covers the food and beverage, mining and garment sectors, which are associated with a high level of water risk. This engagement links water policy and practices in these three sectors to the targets of Sustainable Development Goal 6 (to ensure the availability and sustainable management of water and sanitation for all)

ESG Transparency Poland (English Report)

Since 2012, GES together with the Polish Association of Listed Companies, a self-government organization of companies listed on the Warsaw Stock Exchange, has been involved in an educational project ESG analysis of companies in Poland aimed at increasing disclosure and transparency of reporting on non-financial indicators.

Gaining Ground: Corporate Progress on the Ceres roadmap for Sustainability

This report, Gaining Ground: Corporate Progress on the Ceres Roadmap for Sustainability, evaluates how well 613 of the largest, publicly traded U.S. companies are integrating sustainability into their business systems and decision-making. The report— a collaboration between Ceres and Sustainalytics—assesses corporate progress across the four strategic areas first outlined in 2010 in the Ceres Roadmap for Sustainability: Governance, Stakeholder Engagement, Disclosure and Performance.

Combatting Child Labour: Investor expectations and corporate good practice

GES has engaged the cocoa industry for many years to increase its effort in tackling the issue of child labour. As a part of its long-term engagement, GES published its second public report on the issue, including investor expectations and a corporate benchmark of leading cocoa and chocolate companies.

Perspectives on Modern Slavery (Australia)

An estimated 40 million people are currently oppressed by modern slavery and companies are under increasing pressure to manage this issue to mitigate operational disruptions as well as compliance and reputational risks. Sustainalytics, FSI and Suncorp tackle this issue on Sustainalytics’ Perspectives on Modern Slavery – Australia webinar.

.tmb-small.jpg?Culture=en&sfvrsn=8465a62d_2)

.tmb-small.jpg?Culture=en&sfvrsn=98d0d2f9_2)

.tmb-small.jpg?Culture=en&sfvrsn=f65b13c5_2)

.tmb-small.png?Culture=en&sfvrsn=fd535425_2)

.tmb-small.png?Culture=en&sfvrsn=2b395014_2)

.tmb-small.png?Culture=en&sfvrsn=12e8d376_2)

f6f40ef6-31ad-42df-b35f-128241ea958e.tmb-small.png?Culture=en&sfvrsn=3c436c0f_2)