The Budding Cannabis Industry: A first look at ESG Considerations

While investors are being drawn to the cannabis industry by the lure of an expanding market and profit potential, uncertainties around regulations, scalability and potential stock price corrections remain. Underexplored ESG risks could also present material concerns for management teams and investors entering the industry.

ESG Transparency Poland (Polish Report)

Since 2012, GES together with the Polish Association of Listed Companies, a self-government organization of companies listed on the Warsaw Stock Exchange, has been involved in an educational project ESG analysis of companies in Poland aimed at increasing disclosure and transparency of reporting on non-financial indicators.

Sustainalytics' Feeding the Future Engagement

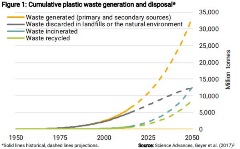

Food production is a leading contributor to global GHG emissions, deforestation, water stress and biodiversity loss, and the sector is increasingly under scrutiny to mitigate its environmental footprint. A failure to manage related impacts and adapt to changing consumer trends could result in material business risks or missing out on opportunities. Land and forest investments could become stranded assets. Sustainalytics will also provide a preview of its new thematic engagement, Feeding the Future.

Sustainalytics’ CEO Michael Jantzi Featured in Clean50 Webcast Series

We are excited to share that Sustainalytic’s CEO Michael Jantzi, participated in a clean finance podcast hosted by Canada Clean50 as part of their #CleanReset initiative. In the company of fellow leading clean finance experts, the dialogue is an insightful overview of how Canada’s current position on ESG regulation may impact financial sustainability for large Canadian corporations.

Access to Nutrition Index 2016

Since the launch of the first Index, recognition of the human and economic consequences of poor nutrition has increased. Globally one in three people are now either undernourished, overweight or obese. Over the last 35 years obesity has more than doubled and has now reached epidemic proportions. Over the next 10 years, malnutrition is set to continue to increase.

Investor Guidance on Integrating Children’s Rights into Investment Decision Making

Sustainalytics in collaboration with UNICEF, The United Nations Children’s Fund, has published a new report titled, Investor Guidance on Integrating Children’s Rights into Investment Decision-Making. The guidance offers investors a practical toolkit on how to incorporate children’s rights into investment analysis and engagement activities.

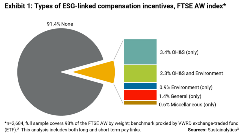

The State of Pay: Executive Remuneration & ESG Metrics

With investors increasingly incorporating ESG considerations into their investment decisions, many are looking into how corporate leadership may be incentivized to pursue an ESG agenda. This report offers insights to global equity investors considering pay-links as a topic for corporate engagement.

10 for 2020: Creating Impact Through Thematic Investing

The UN Sustainable Development Goals (SDGs) are playing an increasingly important role in shaping the sustainability roadmaps of investors, governments and civil society groups. In Sustainalytics’ thematic research report, 10 for 2020: Creating Impact Through Thematic Investing, we present investors with ten ESG investment themes that can positively contribute to advancing the SDGs.

The ESG Risk Ratings: Exploring the Internet Software and Services Subindustry

In the second installment of our ESG Risk Ratings white paper series, we assess the unmanaged ESG risk of 42 Internet Software and Services (ISS) companies. In addition, the report offers a comprehensive ESG risk analysis of the subindustry and concludes with a case study of Facebook.

10 for 2019: Systemic Risks Loom Large

In 10 for 2019: Systemic Risks Loom Large, we offer a forward-looking view of significant ESG issues that could affect global investment portfolios in 2019. Applying Sustainalytics’ ESG Risk Ratings framework, we identify a selection of subindustries with high levels of unmanaged risk and profile 10 firms with leading ESG management practices and low levels of unmanaged ESG risk.

EU Action Plan Guidance Document

The proposed Taxonomy is a classification tool to help investors and companies make informed investment decisions on environmentally friendly economic activities. It is a list of economic activities, which defines performance criteria for six environmental objectives.

The ESG Risk Ratings: Potential Applications for Investors

With our third ESG Risk Ratings white paper, we explore how investors could potentially apply the ESG Risk Ratings to their investment processes. Below are some key takeaways from the white paper. To learn more, register for our regional webinar using the buttons at the bottom of the page.

.tmb-small.png?Culture=en&sfvrsn=22076ca_2)