Tomorrow’s Board: Challenges in a Fast-Changing World

The world is changing faster than it ever has. As a result, companies are increasingly facing numerous and complex challenges with both immediate and long-term impacts. Today, companies are facing a health crisis, a social justice crisis and a fallout economic crisis. The ongoing COVID-19 pandemic and the social justice crisis, calling for the end of systemic racism, have reinforced the need for more diverse boards.

Antitrust in the Digital Age

On July 27th, the chief executives of four (Alphabet, Amazon, Apple and Facebook) of the world’s most prominent technology companies will appear before the US Congress as part of an ongoing antitrust investigation into their market power.[i] This is the latest in a series of developments that includes federal and state-level investigations in the US into the market practices of these companies. Back in 2018, as part of Sustainalytics publication, ESG Risks on the Horizon, our team had noted that the antitrust related scrutiny of major technology companies is likely to persist given the market concentration these companies had established within the digital economy. While there is significant uncertainty as to the ultimate regulatory response, given the outsized position of these four companies in the S&P 500 and sustainability indices, this type of regulatory and market scrutiny is an area that is important for investors to examine in terms of long-term risks to the enterprise value of these companies.

Corporates leverage ESG Peer Performance Insights as a risk management tool

As the social and economic challenges of 2020 continue to unfold and markets remain in flux, the resilience of Environmental, Social, and Governance (ESG) investing marks a silver lining. In the context of today’s bear market, investors are demonstrating their preference for sustainable funds over traditional ones, with Q1 2020 seeing a global influx of USD 45.6bn, compared to outflows of USD 384.7bn for the overall fund universe. Europe has continued to account for the majority of this inflow into sustainable funds, while the U.S. has picked up pace with a 100% y-o-y increase, the highest regionally. Furthermore, Morningstar reported that 89%, or 51 out of 57, of its sustainable indices outperformed their market peers in Q1 2020. For ESG practitioners, this may not come as a surprise as experience has shown that companies with robust corporate cultures and sustainable business practices are best-positioned for long term resilience and growth, leading to stickiness of ESG investments.

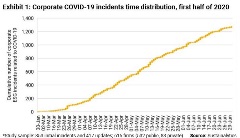

Understanding ESG Incidents: Key Lessons for Investors

Our Thematic research report, Understanding ESG Incidents: Key Lessons for Investors, provides a complete exploration of Sustainalytics’ incidents collection framework and offers comprehensive insight into company activities that generate undesirable social or environmental effects.

The Race to Net Zero: Decarbonization Commitments in the Oil & Gas Industry

Recent reports concerning record decreases in global greenhouse gas (GHG) emissions due to the COVID-19 pandemic have spurred hope for a “green shift” in our global economy, post-pandemic. The importance of this shift cannot be understated, given that capital investments made within the next five-to-ten years will determine the world’s carbon pathway to 2050 and beyond.

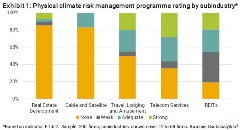

Airlines Post-COVID-19: The Challenges to a Climate-Friendly Recovery

Planes grounded, borders closed and passengers staying at home: the past months haven’t been easy for the airline industry. COVID-19 has led to the deepest crisis ever in the history of the sector.[i] Airlines are in dire need of cash to recover, while at the same time the industry is also expected to adapt and prepare itself for the more critical crisis ahead that is climate change. Despite the slowdown of air travel, long term prospects of mitigating carbon footprint of the industry are not clear. Carbon commitments supported by comprehensive programs are in place, nonetheless, our research suggests that existing measures may not be sufficient to curve down emissions and mitigate climate change.

The Shift to Remote Work: Examining the Risk Landscape

This blog post is the first in a two-part series. In our initial article, we will explore cybersecurity and remote work during the COVID-19 pandemic and its role in expanding an enterprise’s attack surface. In our next blog post, we will examine privacy issues related to COVID-19 contact-tracing.

Cruising Post-COVID-19: Lessons and Challenges for the Cruise Ship Industry

In this blog, we assess the impacts of COVID-19 on the cruise ship industry by taking a closer look at the four biggest cruise companies and their COVID-19-related controversies since February 2020. We also gauge their management of product governance and human capital issues, with the aim of informing investors of each company’s preparedness to address relevant risks as well as challenges and potential hurdles in the industry’s post-pandemic operations.

Responsible Cleantech: The Processes Behind the Products

The growth of the cleantech industry seems resilient from an economic perspective. For it to maintain its social license-to-operate, however, it will also need to formulate answers to the environmental and social challenges throughout its value chains.

What are Sustainability Linked Loans (SLLs)?

A Sustainability Linked Loan is focused on incentivizing sustainability improvements among corporate borrowers by linking the terms of the loan to their overall sustainability performance targets. SLLs can be used for general corporate purposes as the terms are tied solely to the borrower’s ESG-related performance.

Beer, Wine & Spirits in the Era of COVID-19

Companies operating in the Beer, Wine and Spirits subindustry have suffered from knock-on effects of COVID-19 lockdown measures, as governments across the globe have moved to close hotels, bars and restaurants, and ban large events and gatherings, such as festivals and sports events. Given that these venues are an important source of revenue for alcohol companies, investors within this space may benefit from a closer look at how firms have adapted to the rapidly changing market conditions.

Corporate ESG Ratings in Latin America: Use Cases for Companies and Banks | Webinar

To take advantage of the demand for ESG-related disclosure and communicate their sustainability achievements to internal and external stakeholders, many forward-looking companies are leveraging ESG information in their capital raising activities and marketing efforts.

Coronavirus: Are We Protecting the Most Vulnerable?

As the COVID-19 pandemic swept across the globe at the start of 2020, frontline medical care became a top priority in stopping the virus. Contrary to the improvement in case management at hospitals, the number of cases in long term care homes (LTCH) rose sharply. With the situation evolving by the hour at times, the number of infections and deaths rose exponentially in the US.

.tmb-small.jpg?Culture=en&sfvrsn=98d0d2f9_2)

.tmb-small.jpg?Culture=en&sfvrsn=f65b13c5_2)