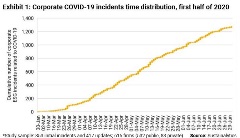

Coronavirus: Are We Protecting the Most Vulnerable?

As the COVID-19 pandemic swept across the globe at the start of 2020, frontline medical care became a top priority in stopping the virus. Contrary to the improvement in case management at hospitals, the number of cases in long term care homes (LTCH) rose sharply. With the situation evolving by the hour at times, the number of infections and deaths rose exponentially in the US.

Coronavirus: Food Security in a Global Pandemic

As Covid-19 continues to ravage the world, governments have responded with movement restrictions and border closures. While necessary to protect public health, these stricter safety measures are disrupting food supply chains globally, forcing prices upward and increasing the risk of social unrest.

Sustainable Fund Labels: Diverse Definitions of Sustainability

Sustainable financial products are marked with an increasingly large list of tags, from green, sustainable, socially responsible to thematic ESG, water, carbon or impact funds, and not every investor might know how to make sense of these terms. Sustainable fund labels can be one way to signal to the market that the fund has a dedicated responsible investment strategy.

How Investors Integrate ESG: A Typology of Approaches

This report, How Investors are Integrating ESG: A Typology of Approaches, classifies ESG integration approaches along three dimensions: management (who is integrating ESG), research (what is being integrated), and application (how the integration is taking place). The authors then used the typology to identify six prevailing approaches of ESG integration in the market today.

ESGarp Scores: In Search of Reasonably Priced, Low ESG Risk Stocks

The COVID-19 pandemic is likely to further amp up the market’s interest in ESG investment research. It’s not just that ESG funds and indices have generally outperformed their non-ESG counterparts since the COVID-19 sell-off began in mid-February.[i] It’s also that the pandemic itself has drawn attention to ESG issues ranging from biodiversity and habitat loss to employee relations and supply chain management.

Vehicles and Ventilators: An ESG Lens on Automakers Pivoting to COVID-19 Solutions

Automakers have been hit hard by the COVID-19 pandemic, with widespread plant closures, stalling demand for vehicles and mounting tensions between corporate management teams and government bodies. On the upside, several auto companies have responded to the global health crisis by pivoting parts of their business models to supply the growing demand for ventilators needed for patients suffering from severe respiratory symptoms of COVID-19.

2020: The Year of the Flexitarian

The Economist named 2019 the year of the vegan; however, veganism is one part of a much greater trend away from animal proteins. While vegetarianism also continues at a steady growth rate, it is the flexitarian – i.e. traditional meat eater who makes a conscious effort to reduce their meat intake – that is having a notable impact on the market. This has been further accelerated by COVID-19 and the disruption to the fresh meat industry.

Future of Cement: Low-Carbon Technologies and Sustainable Alternatives

At a time when climate change has caught global attention and efforts are being made to meet the UN sustainable development goals, however concrete – the most widely used man-made material on earth – is a significant source of carbon dioxide (CO2) emissions and often overlooked. Cement, a key ingredient in concrete, accounts for about 7% of global CO2 emissions and is the second-largest industrial emitter of CO2 after the iron and steel industry [i]. The cement production process is responsible for 95% of concrete’s carbon footprint. Under the International Energy Agency’s sustainable development scenario, cement producers will need to reduce their carbon intensity at an annual rate of 0.3% per tonne of cement produced up to 2030 [ii]. With carbon emission regulations tightening globally to meet the 2-degree scenario (2DS) targets, cement companies that fail to adopt low-carbon processes and improved energy efficiency could face risks in the form of potential fines from non-compliance and lost opportunity costs by failing to innovate processes.

Coronavirus: Are Companies Prepared to Take Care of Their Employees?

In April 2020, the International Labour Organisation (ILO)[i] estimated that in the second quarter of 2020 there will be a 6.7% decrease in working hours globally (approximately 195 million full-time employees), primarily in the sectors hardest hit by the Coronavirus pandemic: food service, manufacturing and retailing.

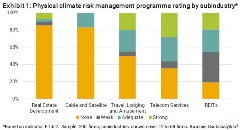

Climate Action, Human Health and Responsible Investing

This year, we mark Earth Day under a pandemic. To date, casualties of the novel coronavirus include more than 170,000 deaths, ongoing disruptions to healthcare systems and a deep economic downturn. As we face the first global recession in a decade, Earth Day – the theme of which this year is climate action – serves as a reminder for investors to reflect on how their investment activities relate to social and environmental health concerns.

Tackling the Climate Crisis: Mobilizing the Transition

As we mark the 50th Anniversary of Earth Day, we highlight the need for a collective effort in order to combat the impacts of climate change. In this blog, we explore the important role that investors play in mobilizing the transition to reduce emissions and how sustainable solutions can support this.

The Quest for Supply Chain Resilience: Where Business Sense and Thriving Rural Communities Meet

In this blog post we highlight the need for living income and living wages to build resilient supply chains and resistance to shocks such as the current COVID-19 pandemic. We explore the important role that investors play and how engagement efforts contribute to progress.

Coronavirus: Human Capital Management During and After the Pandemic

The coronavirus pandemic has been sudden and significant. The transition from business as usual to crisis response has meant that daily routines are no long routine and future planning is in a state of constant revision. We are learning new ways to source essential goods and connect with people. The same applies to companies. While truly exceptional, the pandemic illustrates the importance of proactive business planning and robust risk management systems, with companies’ ability to respond to shocks and adapt to changing circumstances being tested profoundly.

CII Conference Reflections: Emerging Social Issues to Watch for in 2020

Following the Council of Institutional Investors Conference, we highlight two emerging social issues that were top of mind for active investors, Cyberthreats and Human Capital & the Future of Work, and discuss how partnering on engagement can drive long-term value.

Coronavirus and the Localization of Supply Chains

One of the lasting impacts of the COVID-19 pandemic will surely be a transformed understanding of supply chains. As we touched on in earlier posts[i] in our coronavirus blog mini-series, we expect the pandemic to catalyze a range of efforts by management teams to better understand the vulnerabilities of their supply chain. While executive teams closely track their tier 1 suppliers, many are unaware of the full scope of their global supply chain. Bain & Co recently estimated that up to 60% of executives have no knowledge of the items in their supply chain beyond the tier 1 level.[ii]

Pre-engagement study on labour rights in food supply chains

Labour rights issues in food supply chains are crucial matters to investors, both in terms of compliance with international human rights norms and national legislation, and from the material point of view of securing future supplies. With this background, GES, in collaboration with AP7, The Seventh Swedish National Pension Fund, conducted a pre-study to provide input for the development of a new engagement initiative.

5G and Industry 4.0: Enabling Efficient and Resilient Infrastructure

There is significant hype associated with the rollout of 5G networks, which is largely tied to the incredible data transfer speeds 5G capable networks can offer. However, speed is only part of the equation. Beyond speed, key attributes of 5G also include lower latency, reduced cost per gigabyte and larger connection volumes. 5G, unlike previous network technology, will be software-defined, enabling networking functionality to be flexible and adaptable over time.[i] As a result, 5G is anticipated to create a new digital backbone to power future infrastructure needs – a topic we explored in Sustainalytics’ report, 10 for 2020: Creating Impact Through Thematic Investing.

.tmb-small.png?Culture=en&sfvrsn=fd535425_2)

.tmb-small.png?Culture=en&sfvrsn=2b395014_2)