ESG Risk Around the World: A Comparative Analysis Between Developed and Emerging Markets

This reports tracks and examines the ESG attributes of companies in emerging and developed markets from 2018 to 2022. It sheds light on recent developments, showing how companies in developed and emerging markets are improving their ESG Risk Ratings at different paces.

Automotive Workers and the EV Revolution: How the Pivot to Electric and Connected Vehicles is a Human Capital Risk

A rapid shift to scale the production of electric, connected vehicles demands significant changes to both the size and skillset of the auto industry’s workforce. This article examines how these challenges are impacting the automotive industry.

From Commitment to Action: Corporate Realities and Strategies for Biodiversity Stewardship

With global biodiversity goals established and science-based targets for nature developed, the scaffolding is in place for companies to begin changing course. This article highlights key areas to advance progress through stewardship initiatives in 2024.

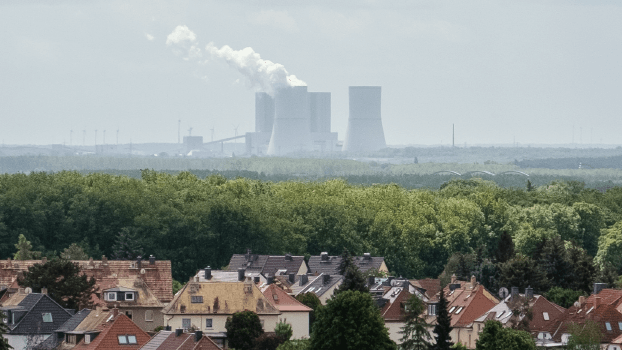

Reducing Emissions Through Sustainable Finance: A Guide for Companies in Carbon Intensive Industries

This corporate guide discusses the difficulties in measuring, reporting, and reducing GHG emissions in hard-to-abate sectors and provides key takeaways so that companies can take advantage of the opportunities sustainable finance offers.

Double Trouble: The Rise of Greenwashing and Climate Litigation for Banks

The fight against greenwashing is being taken to the courts. An analysis of Morningstar Sustainalytics data shows a 12-fold rise in climate-related litigation, including greenwashing claims, against banks over the past three years.

Artificial Intelligence for ESG Assessments

Learn how AI enables us to quickly analyze large, diverse datasets and provide a comprehensive view of a company's ESG analytics. Embracing AI for ESG assessments is not only a value added for investors, but also a crucial step for the ESG industry to foster a sustainable financial future.

Climate Transition Risk: 6 Investor Questions Answered

This video interview provides insight into the challenges institutional investors face as they struggle to comply with the growing slate of climate-related reporting frameworks and standards, while trying to identify, manage and mitigate climate transition risks in their portfolios.

Constructing Zero Deforestation Portfolios to Combat Climate Change and Biodiversity Loss

The world’s forests are under threat, putting ecosystem services and global economic wealth in danger. But investors can help to fight deforestation. In this article, learn the reasons why investors should pursue zero deforestation portfolios.

ESG in Conversation: ISSB Sets New Standards for Sustainability Reporting

In this episode, learn about the upcoming greenhouse gas reporting requirements for North American companies, EU's Fit for 55 package and the implication for companies in the region, and what the newly published ISSB standards mean for companies and investors.

SDGs and ESG: Why the United Nations Sustainable Development Goals Should Top Every Boardroom Agenda

The world is failing to achieve the UN Sustainable Development goals, with just 15% of targets on track. In this article, we explore the role of SDGs in developing sustainability objectives and how boards of directors can make progress on their targets.

Global Greenwashing Regulations: How the World Is Cracking Down on Misleading Sustainability Claims

Amid fears of greenwashing claims and evolving reporting standards, sustainable investment assets have dropped as much as 51 percent. In this rapidly changing environment, ESG stewardship is one of the most effective ways to integrate genuine sustainability principles into investment management.