Deepwater Plays Against Rising Risks: The U.S. Gulf of Mexico

As onshore resources became harder to locate over the past decades, offshore exploration and production have grown into a global industrial activity. The prospect of finding hydrocarbons has led some companies to explore deeper waters in some regions.

Applications of Country Risk Ratings in Fixed Income Investing

How are Country Risk Ratings being utilized to identify risk and to construct a sovereign ESG fixed income index? Listen in as Manna Neghassi, Manager, Product Strategy and Development at Sustainalytics and Katie Binns, Senior Product Manager, Fixed Income Indexes at Morningstar Indexes tell us more.

10 for 2021: Investing in the Circular Economy

This report aims to support investors interested in gauging environmental, social and governance (ESG) risks and opportunities in the global food value chain. We survey key subindustries – from agrochemicals, agriculture and aquaculture to packaged food, food retail and restaurants – in search of solutions that may support the principles of the circular economy (CE). These principles include minimizing waste and pollution, extending the use-phase of products and ecosystem regeneration. Some of the key insights found in the report are:

Lessons Learned from 926 Engagement Meetings in Emerging Markets

When Sustainalytics (GES[1]) initiated the Emerging Markets (EM) Engagement program as a pilot project in 2009, the scale, scope and impact were undetermined factors. Based on the successful execution of the program methodology in the African and Middle Eastern regions during the pilot stage, the full program launched in 2010 to cover all major emerging markets. After the project close in July 2020, the program accounts for 926 meetings with companies in emerging markets.

ESG at a Reasonable Price in China

Over the last decade, portfolio managers worldwide have been increasingly convinced that incorporating environmental, social, and governance (ESG) criteria into investment decisions could provide better risk-adjusted returns. As a result, responsible investing, has moved from a niche activity to the mainstream. As more capital shifts to ESG products, there have been discussions regarding the risk of an ESG bubble as stocks with good ESG scores have enjoyed price appreciation and sometimes go beyond fundamentals[i].

ESG Transparency Poland (English Report)

Since 2012, GES together with the Polish Association of Listed Companies, a self-government organization of companies listed on the Warsaw Stock Exchange, has been involved in an educational project ESG analysis of companies in Poland aimed at increasing disclosure and transparency of reporting on non-financial indicators.

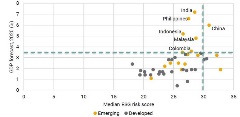

Emerging Markets Equities: Key Sources of ESG Risk

Based on our analysis, we find that investors in the FTSE Emerging Index are exposed to over 14 percent more unmanaged ESG risk than those in the FTSE Developed Index. The ESG risk gap between these indices is largest on the issue of data privacy and security. In addition, investors in select equity markets, such as China, may face a trade-off between chasing higher economic growth and mitigating portfolio ESG risk.

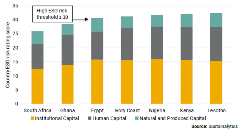

New Frontiers: African Sovereign Debt and ESG Risk

In New Frontiers: African Sovereign Debt and ESG Risk, we leverage our Country Risk Ratings to analyze ESG risk among African countries. Our findings show country-level ESG risk and average sovereign credit ratings exhibit a strong positive correlation.

ESG Transparency Poland (Polish Report)

Since 2012, GES together with the Polish Association of Listed Companies, a self-government organization of companies listed on the Warsaw Stock Exchange, has been involved in an educational project ESG analysis of companies in Poland aimed at increasing disclosure and transparency of reporting on non-financial indicators.

South Africa and ESG Risk

A Case Study On November 1, 2019 Moody’s cut its rating outlook for South Africa from “Baa3 stable” to “Baa3 negative,” putting the country’s bonds on the cusp of junk status after several harbingers of a potential downgrade.[i] Earlier this year, the World Bank and the International Monetary Fund cut their 2019 growth forecasts for South Africa to around 0.8%, while the Institute of International Finance warned that the country’s public debt could grow to 95% of Gross Domestic Product (GDP) by 2024.[ii] The other two big credit rating agencies (CRAs) – Fitch and S&P – downgraded South Africa’s credit rating to sub-investment grade back in 2017, citing a deterioration in the country’s public finances.[iii]

Revising Mining Codes: Equality for Nations or Nationalization?

In recent years, an increasing number of nations, particularly in Africa, have been amending their mining codes. Governments likely view these amendments as a way of getting more for their people from their natural resources. But are these amendments slowly leading to the nationalization of the sector in some of these countries and how are the companies reacting?

The Impact of Country ESG Risks on Company Operations

In this article we explore how operating in Peru affects the world’s second largest mining producer of precious metals, Barrick Gold. Based on analysis from our recently launched Country Risk Ratings, we discuss how the challenges facing Barrick’s mining operations in Peru are strongly influenced by the country’s ESG risks.

Emerging market equities, ESG risk and sector tilts

The International Monetary Fund’s (IMF’s) recent downward revision to its projections of near-term global expansion reflects growing concerns about brewing market tensions. Central issues affecting capital markets include trade disputes between the US and China, Brexit and subdued investment and demand for consumer durables. According to the IMF’s latest outlook, global real GDP will grow 3.2% in 2019 and 3.5% in 2020 – a downgrade of 10 basis points (bps) for each year compared to the IMF’s previous outlook last April.[i]

The Democratic Republic of the Congo – Presidential elections and mining, what’s next?

Updated March 4th, 2019 On the December 30th 2018, presidential elections finally took place in the Democratic Republic of the Congo (DRC), the first “democratic” elections in the country’s history. A peaceful transition of power in the region is of particular significance to the mining and renewable energy sectors. The DRC produced an estimated 58 per cent of the world’s cobalt in 2018, an essential element in battery technology. Any political instability or collapse into violence after the elections could restrict cobalt supply and potentially drive up the cost of batteries.

A hope for stability in South Africa

During GES’ recent Emerging Markets Engagement trip to South Africa, we held several meetings with mining companies and, for the first time, with the South African government’s Department of Mineral Resources (DMR) and the Minerals Council South Africa, the mining industry’s trade body.

f6f40ef6-31ad-42df-b35f-128241ea958e.tmb-small.png?Culture=en&sfvrsn=3c436c0f_2)

.tmb-small.png?Culture=en&sfvrsn=22076ca_2)