Coal Investments: Up in Smoke?

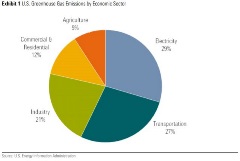

Growing public concern over climate change is pushing investors to increasingly assess how their portfolios are pivoting to a low carbon economy. Because of its large carbon footprint, the coal industry is a prime target of environmental activism and divestment campaigns, and it is becoming the investable hot potato few want to hold.

The Budding Cannabis Industry: A first look at ESG Considerations

While investors are being drawn to the cannabis industry by the lure of an expanding market and profit potential, uncertainties around regulations, scalability and potential stock price corrections remain. Underexplored ESG risks could also present material concerns for management teams and investors entering the industry.

Nuclear Power and ESG: Can They Play Together?

Nuclear power in particular can be a controversial and confusing topic with respect to ESG factors. Sustainalytics, a leading global ESG and corporate governance analytics firm, has joined Morningstar Research Services to present a comprehensive ESG analysis of nuclear power, including a look at carbon emissions intensity, waste management, operational management, public safety, worker safety, and regulatory oversight.

Shipbreaking: Clean Shipping in Deep Water

Cleaner shipping has been a trending topic particularly since the International Maritime Organization (IMO) declared that 2020 will mark the “beginning of a decade of action and delivery” for the shipping industry.[i] A key approach to cleaner shipping is for companies to renew their fleet with more environmental-friendly vessels. However, this approach triggers an obsolescence of older vessels and increases shipbreaking activity. In Sustainalytics’ 10 for 2020 report, we mention the issue of shipping practices with large environmental impacts including shipbreaking practices which we will explore more in depth in this article.

PFAS Sparks a Wave of Litigation in the U.S. Chemical Industry

In 2019, a wave of litigation related to per- and polyfluoroalkyl substances (PFAS) emerged in the United States, as several states filed lawsuits against PFAS manufacturers, including DuPont, Chemours and 3M. This legal action accompanies increased regulatory scrutiny of this potentially risky class of chemicals. In this article, we will focus on the risks chemical companies face related to PFAS contamination of drinking water in the United States and the ESG risks posed to chemical companies and their investors.

The Opioid Crisis and the Continued Uncertainty for Affected Companies

As the first National Prescription Opiates Multidistrict Litigation (MDL) cases are set to get underway in late October, we take a closer look company involvement in U.S. opioid crisis and how it has evolved since our first article on the topic in 2017. We also provide an overview of how the ESG risks highlighted in our initial article have materialized over the last two fiscal years (FY2018 and FY2019) for the companies involved.

Controversial Weapons: Regulatory Landscape and Best Practices

Since the beginning of modern warfare in the 20th century, we have witnessed the development of weapon types that have a severe, disproportionate and indiscriminate impact on civilians, even years after a conflict has ended. Over the past decades, several protest movements have attempted to halt and ban the production of specific, controversial weapon types, and many countries have adopted international conventions to this effect. More recently, some financial institutions have begun to restrict or exclude financing of companies with involvement in certain weapons. This article explores what investors can do, beyond existing legal frameworks, with respect to controversial weapons.

Point of Sale Financing: Inclusive for all?

What is Point of Sale Financing? Point of sale financing (PSF) is a relatively new financial product that has garnered significant interest from consumers, retailers and financial institutions. It provides financing to markets that were previously underserviced by conventional financial products but can also be a gateway to impulsive spending and poor financial choices if not managed properly. This article provides a brief overview of PSF, the pros and cons for consumers, a comparison of PSF with conventional lending vehicles and a sector review looking at policies addressing financial inclusion.

Can Italian Banks Avoid Another Financial Crisis?

Italy is the birthplace of the accounting and credit systems and is home to some of the world’s oldest banks. Despite this legacy, poor lending decisions in the past decade and a high number of non-performing loans (NPLs) is putting the Italian banking sector at risk. This article will explore the connection between responsible product marketing practices and the financial stability of Italian banks by analyzing Sustainalytics’ ESG data.

Self-Driving Technology: Risks and Opportunities through an ESG Lens

As technology and automobile companies race to bring autonomous vehicles (AVs) to the road, we consider the ESG risks and opportunities facing this disruptive technology. Estimates of when AVs will be fully automated vary (Figure 1); however, the consensus is that AVs are inevitable and different stages of automation will be slowly introduced.

Implications of Consolidation in the Pharma and Biotech Sector

Increasing consolidation within the pharma and biotech industry has triggered questions about the ultimate impact on the industry, as well as on its stakeholders. With increased competition from generic manufacturers and rising drug development costs, several pharmaceutical companies have engaged in M&A as a defensive strategy to offset losses in market share and gain cost savings. While M&As are typically scrutinized by authorities for harming competition, another question has emerged: does consolidation harm innovation and ultimately the industry’s capacity to develop lifesaving drugs?

ESG Spotlight | Assault Weapons: assessing exposure to the firearms trade

The Parkland shooting prompted a swift reaction from many influential corporations and investors. A growing list of corporates, including Delta Air Lines, Enterprise, Symantec and First National Bank of Omaha, have cut ties with the National Rifle Association.

Antimicrobial Resistance: A life-threatening issue

Since their introduction, antibiotics have saved millions of lives by reducing complications and mortality associated with infectious diseases. However, widespread use of antimicrobial drugs is also closely associated with an increase of antimicrobial resistance (AMR). As the makers of these drugs, pharmaceutical companies can play a big role in battling AMR. Without their efforts, the prospects for successfully combating the issue are dim.

Regulating the Chemicals Industry: How does REACH impact Companies?

Chemical substances are part of our daily lives. They are found everywhere from the cleaning detergents we use to the clothes we wear and our personal electronics. The companies that produce these chemicals, some of which can be hazardous and have a negative impact on human health and the environment, are exposed to several risks and are highly regulated. In Europe, the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation focuses on ensuring the safe use of chemicals, as well as the phasing-out of the most harmful chemical substances. As the third and final REACH registration deadline approaches, we take this opportunity to look at the impact of chemical regulations on the sector and investors.

Nuclear Weapons: The Next “No-Go” Area for Investors?

The start of 2018 brought two interesting developments to the responsible investing community. On January 11th, the Dutch 405 billion euro pension fund ABP announced that it will take steps to exclude nuclear weapons and tobacco companies from its investments. Within a week, Norges Bank declared the addition of five companies to the 870 billion euro Government Pension Fund Global exclusion list due to involvement with nuclear weapons.

Will the Consolidation in the Chemical Industry change its ESG Risk Profile?

When the stock market closes today, the DowDuPont merger will officially be finalized and the new entity will start trading under the ticker DWDP (as of September first). This is the most recent – and certainly one of the most significant – mergers in an industry that has seen unprecedented consolidation. But what are the social and environmental ramifications of this consolidation and does it risk changing the industry’s ESG risk profile?